Russia’s Truck Swap

Supply chains move fast - let’s get ahead: China replaces the EU in supplying trucks, diggers, and tires to Russia; more poor data for PCs; industrial robots take flight; who cares about holidays?

Russia Swaps Europe’s Trucks for China’s

Russia’s invasion of Ukraine has elicited a wide range of sanctions on both its exports and imports. They are reshaping global energy flows (see “Commodities” below) and have started to alter manufactured goods supply chains too, particularly for goods inbound to Russia.

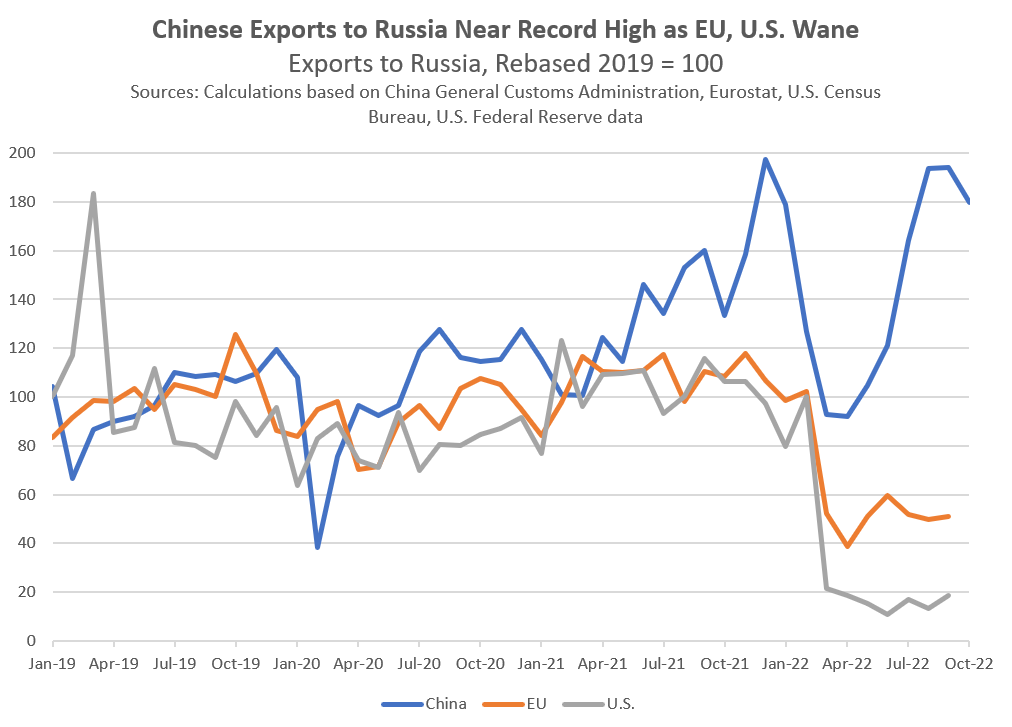

The chart above shows that total exports from the United States and European Union to Russia fell by 84% and 53% respectively in dollar terms in Q3’22 after export sanctions took effect. Exports from China fell earlier in the year, likely reflecting factory closures, but more recently recovered to rise by 23% in Q3’22 before surging 35% higher in October.

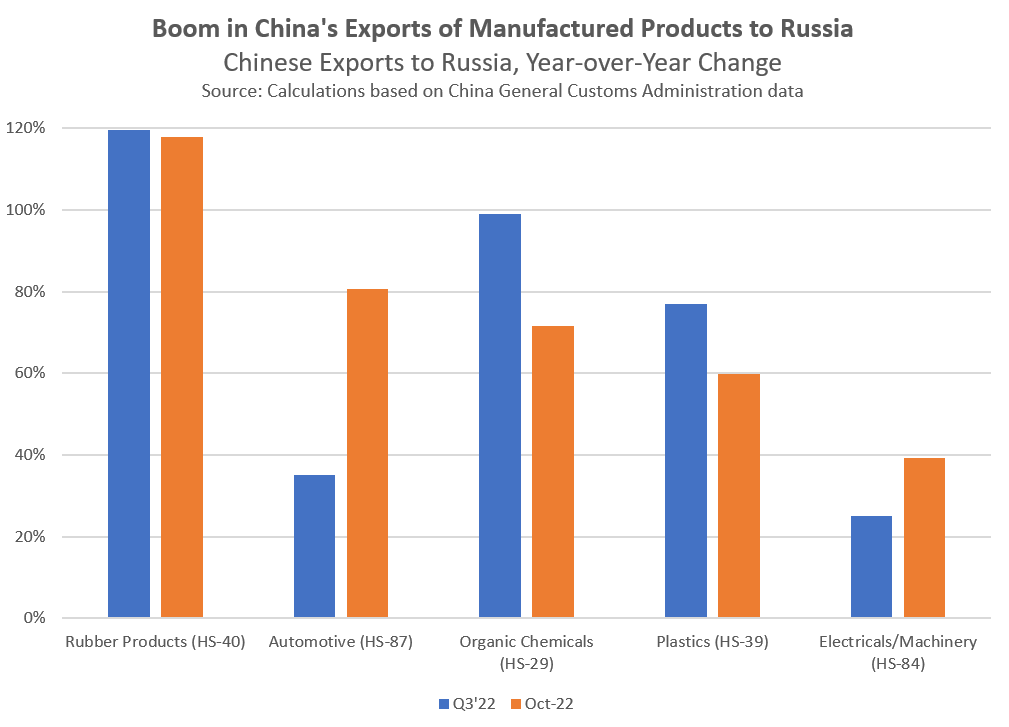

Over 60% of the growth in China’s exports to Russia in dollar terms has been led by five sectors, as shown in the chart above. Exports of electrical and machinery goods (encapsulated by HS-84) and automotive products (HS-87) accounted for 31% of the growth in Q3’22 versus Q3’21 combined.

In terms of growth rates, rubber products (mostly tires) and organic chemicals (including pharmaceutical precursors) expanded by 120% and 99% respectively in Q3’22 vs. Q3’21 respectively. The orange bars in the chart show that growth has continued at similar, or faster, rates for most of the big sectors in October.

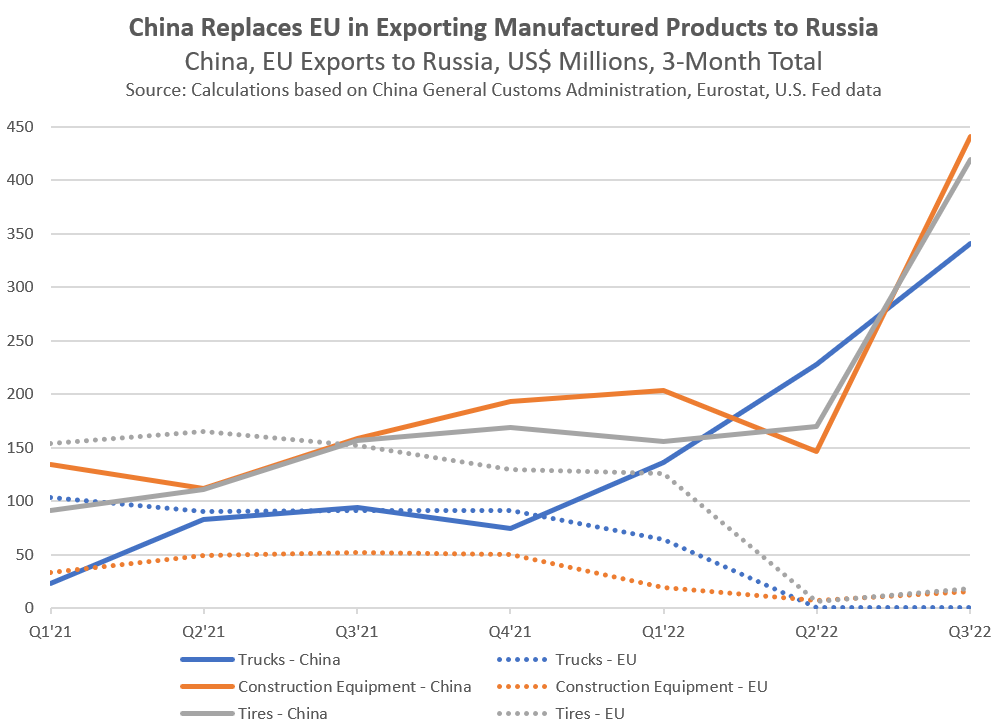

There’s evidence of a marked shift in shipments of vehicles and machinery from EU suppliers to those shipping from China:

The blue line in the chart above shows that shipments of light trucks (HS 8704.23) from China increased by 263% year over year in Q3’22, while those from the EU dropped to near zero. China’s shipments replaced 2.7x those from the EU, suggesting supplies from other countries have also been displaced.

Construction equipment exports, for example, diggers, from China to Russia climbed by 177% in Q3’22 versus Q3’21, shown in the orange lines. The growth in exports from China was 7.8x the drop in shipments from the EU.

The gray lines above show tire shipments from China rose by 167%, replacing 2x the drop in EU exports.

The more rapid expansion in exports from China versus the decline from the EU indicates reduced supplies from other countries, particularly South Korea and Japan. It may also indicate stockpiling ahead of further sanctions as well as spending of increased cash flows to the Russian economy resulting from elevated energy prices.

Technology - Fewer PCs, More Chip Equipment

PC manufacturer Dell reported a 6% year-over-year decline in revenues in Q3’F23, and predicted a decline of 16% for the coming quarter, missing estimates. While demand for PCs is falling, the firm’s inventory increased as it “strategically accelerated purchases of some key components … to navigate through supply chain dynamics.”

HP Inc declared an 11.2% drop in FQ4 revenues versus a year earlier, including a 13% slide in PC revenues. The firm noted that “while supply availability has improved significantly, constraints persisted in some pockets.” Looking ahead, HP expects the “overall PC market to see an approximate 10-point unit decline” for the next 12 months versus the prior year.

Electronics retailer Best Buy saw revenues fall by 11% in the latest quarter, while inventories fell by 15% reflecting “an earlier build of inventory in the prior year.” The firm expects revenues to fall by 10% year over year in the final quarter of the year, which “implies a larger deceleration versus the pre-pandemic” period.

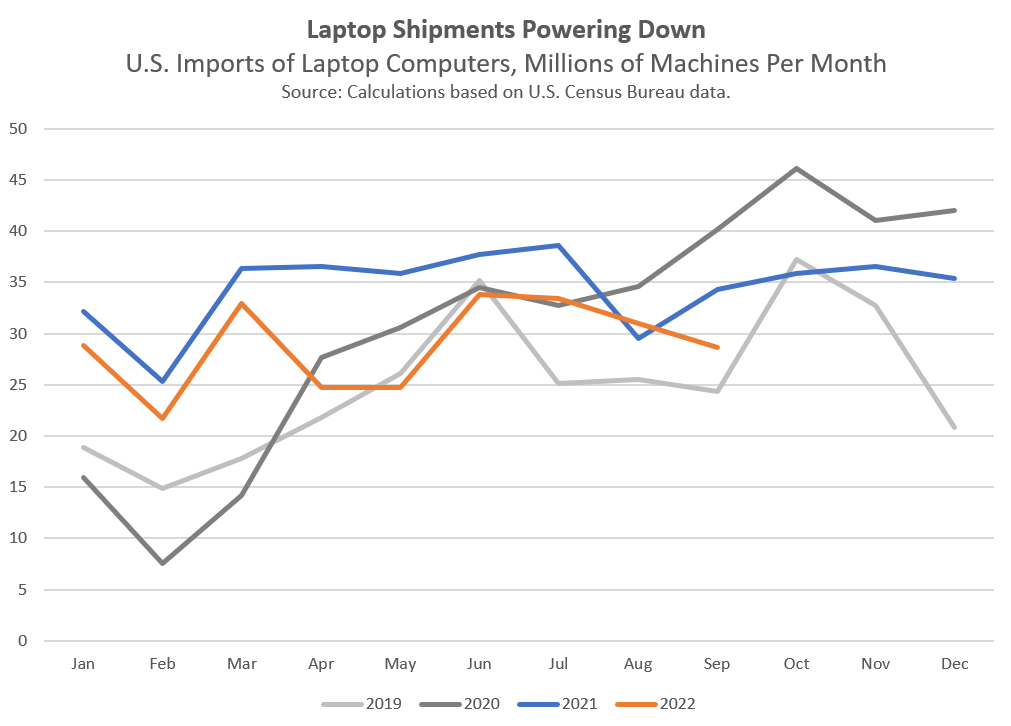

U.S. imports of laptop computers fell by 17% year over year in September, as shown above. That may be linked to importers expecting much lower demand. With 93% of imports coming from China, there may also be COVID-19 related supply chain issues. Imports are still 18% above pre-pandemic (September 2019) levels.

Analog Devices has provided a mixed outlook for demand for its amplifier and power management chips, stating that the coming quarter will see “autos to be up slightly sequentially; industrial about flat; comps to decline by mid-single digits; and consumer to be down double digits sequentially.”

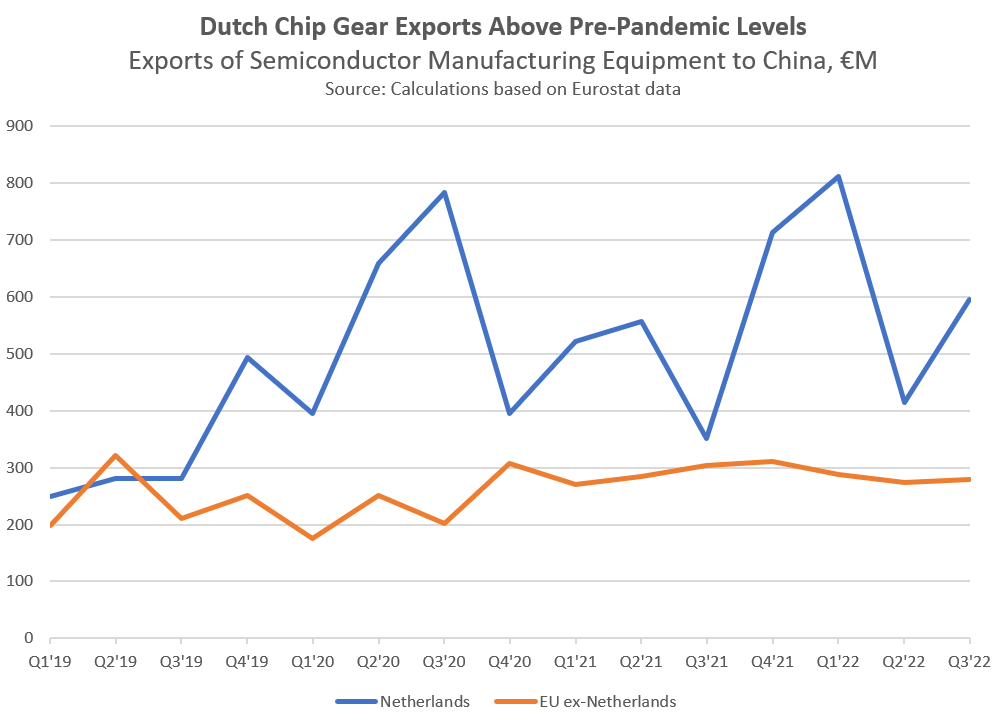

The government of the Netherlands has indicated that it may not follow the U.S. lead in restricting exports of the latest semiconductor machinery to China.

The chart above shows that exports of semiconductor manufacturing machinery from the Netherlands to China surged 70% higher in Q3’22 versus Q3’21 and by 112% compared to Q3’19. That may reflect attempts by Chinese firms to meet elevated demand for semiconductors as well as preempt sales restrictions.

Government intervention is set to continue, ASML has identified $153B of government support for “technological sovereignty”, i.e. onshoring, across the U.S, EU, China and Japan. The firm estimates such onshoring could result in “10% inefficiency of the total installed wafer capacity by 2030.”

Chinese internet firm Baidu has stated it sees a minimal impact from U.S. restrictions on sales of advanced semiconductors. The firm already has a stockpile of chips for its existing needs, and plans to develop its own processors in the future.

EU member states have tentatively agreed to a €43B package of measures to support semiconductor manufacturing investments. The funds will support a wider range of technologies than initially planned, but are not a carte blanche for state aid.

The German government is reportedly planning to require increased national security disclosures from companies with a high dependency on China. The autos and chemicals industries may be an early focus. The DIHK industry association is already calling for additional support for sourcing diversification away from China.

Industrials - March of the Robots

Amazon plans to use its “Sparrow” industrial robot to handle as much as 65% of its warehouse inventory going forward. Increased use of industrial robots in logistics may provide a new leg to growth for the industry.

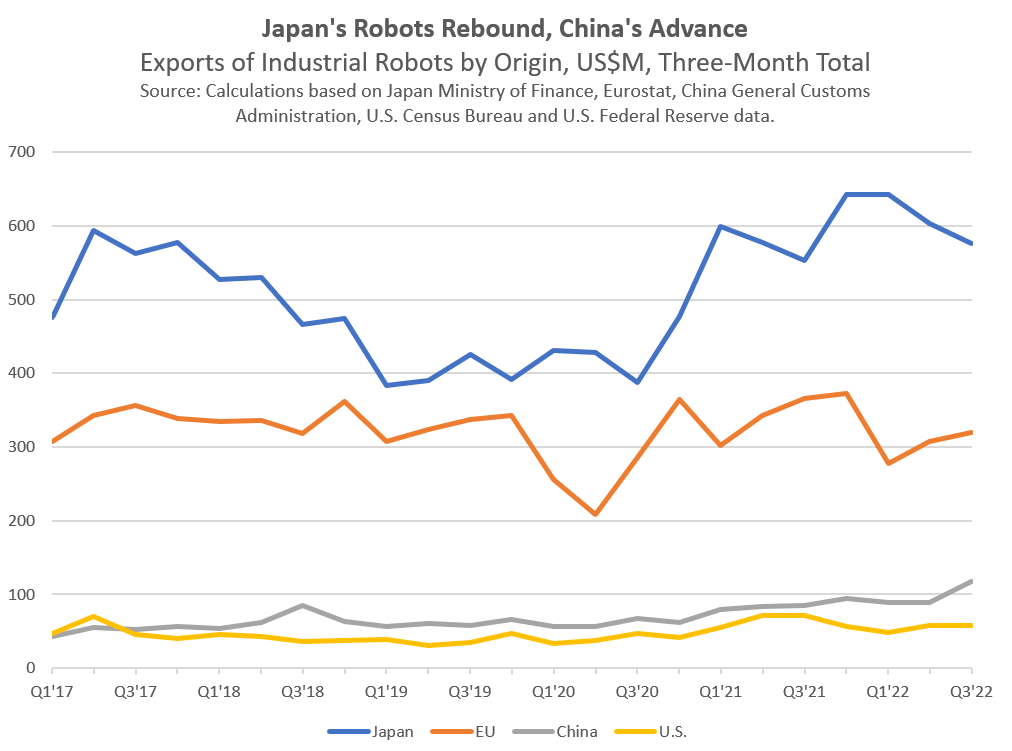

The chart above shows exports of industrial robots from the four largest export centers on a quarterly basis. Combined exports increased by just 2% annually from 2017 to 2021 in dollar terms, with a significant drop and rebound in shipments from Japan during the pandemic. Year-to-date in 2022 the total dipped by 0.1%.

China has led the way, expanding by 13% annually in the past four years and by 19% year-to-date. The latter has come at the expense of shipments from the EU and U.S. which fell by 10% and 17% respectively year-to-date.

LG Chem will spend over $3B to build an electric vehicle battery cathode factory in Tennessee as part of its joint venture with General Motors. The project will leverage funding from the Inflation Reduction Act. The IRA has attracted the opprobrium of the EU, Japan, South Korea and the WTO.

Not all EV investments for North America are heading to the U.S. Nidec will spend $715M on an electric axle plant in Mexico as part of its in-region, for-region manufacturing strategy.

The CEO of Stellantis has stated that “so far, Europe ius unable to make affordable EVs.” The firm may therefore consider production in India, initially for sales into the local market and later on for export.

The Philippines is cutting its import duties on electric vehicles and parts to zero from 5% to 30%. The government is aiming to “expand market sources and encourage consumers to consider acquiring EVs.”

Manufacturing conditions in the U.S. are their worst in 30 months according to the S&P Global PMI. The rate of decline in composite (services and goods) export orders “also gathered momentum.” Manufacturing conditions in the Eurozone improved but still show declining activity.

The latest U.S. Federal Reserve monetary policy meeting minutes flagged reduced supply chain constraints, which cuts the upward pressure on inflation. It also noted that firms are finding it “easier to plan production or had diminished needs to maintain precautionary inventories.”

U.S. rail union strikes could be back on by December 9 after the rejection of an earlier pay-and-conditions deal. Railroads will likely start to park services ahead of the strike, as occurred ahead of the prior deadline. Congress could intervene.

South Korean truckers are on strike again following the breakdown of minimum wage negotiations with the government. The actions include a blockage of the main container ports. A round of strikes in June reportedly caused $1.2B of economic damage.

Commodities - Gas Sold Out

The Japanese government has found that there are no oil-indexed Liquefied Natural Gas (LNG) contracts available until 2026. The contracts are the preferred form for many Asian utility buyers looking to diversify and expand their sourcing.

The government expects the gap between demand and supply to widen through 2025, and the “global LNG competition is likely to heat up further.”

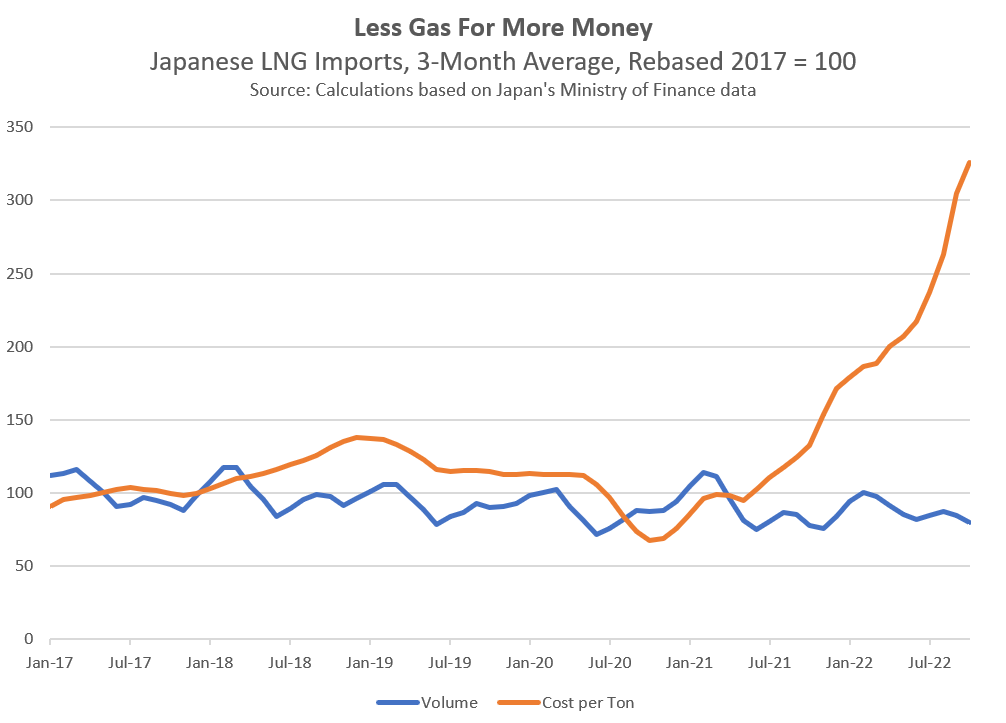

Japan’s demand for LNG has been stagnant. The chart above shows imports in the three months to Oct. 31, 2022 rising by just 2% year over year and down by 3% on an annualized basis over the past five years. The challenge is import prices, which reached the highest on record in Q3’22 and were 1.5x their year earlier level in October.

Contracts to start later are already being signed, with Qatar and China having signed a 27-year deal, making the longest LNG contract on record.

The European Commission has proposed a “Market Correction Mechanism” to cap natural gas prices if they exceed €275/MWh for month-ahead contracts for two weeks and diverge from global LNG prices. The move requires approval by member states, which may take until mid-December.

European month-ahead natural gas prices for December are currently €130/MWh. They only exceeded the proposed cap for a handful of days in August.

The root of the “LNG competition” referred to by Japan has been Europe’s push to buy more LNG to diversify away from Russia. The need has been underscored by a threat by Gazprom to cut supplies via Ukraine due to accusations of diversion of gas meant for Moldova.

A new survey of German manufacturers shows 75% have been able to cut their natural gas use without slashing production in the past six months. However, only 49% expect to continue to be able to do so in the next six months.

The process to set a price cap on Russian oil exports by the G7 has reportedly stalled. EU proposals for a price of at least $65 per barrel are higher than some participants want. The cap is due to be implemented from Dec. 5.

Russia has already confirmed it won’t sell to countries that apply the price cap. Notably, EU oil flows from Russia are already down by around 90% versus pre-war levels.

Trafigura has warned the sanctions could lead Russian oil exporters to use older tankers. That will result in a “heightened risk of accidents occurring.”

The latest OECD economic update shows the share of global GDP spent on energy in 2022 will reach 16.4%, the highest since the second global oil crisis in 1982.

The Indian government has reduced its 50% export duties for low-grade iron ore and concentrates. That follows a decline in global demand for iron ore, as well as Indian exports. The export restriction may have been intended to retain cheaper supplies for domestic steel producers when global commodity prices were soaring.

India only accounted for 2.5% of global exports of iron ore and non-roasted concentrates in 2021. That made it the fifth largest exporter and a similar scale to Ukraine’s.

Retailers - Who Cares About Holidays?

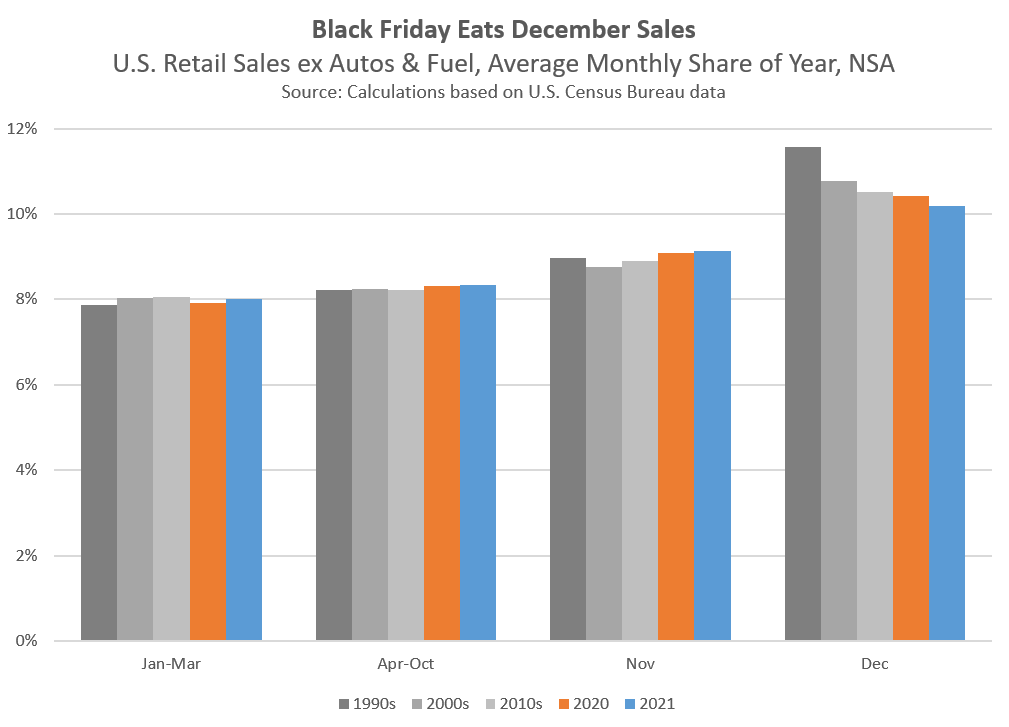

Does the holiday shopping season actually matter for supply chains? The chart above shows the share of each month in U.S. retail sales excluding autos and fuel on a non-seasonally adjusted basis.

December’s share of annual sales has fallen from 11.6% in the 1990s to 10.2% in 2021, while the November and December share combined has held steady at 19.3% to 19.5%. That may suggest earlier shopping as a result of more e-commerce-enabled “Black Friday” discount events.

For context, the November-December sales period is therefore only 20% more important than the rest of the year (i.e. 19.5% over 16.1% for all other two-month periods in the year). For some sectors, particularly electronics and leisure goods (including toys) the two-month period is more important. More on those sectors next week.

Disclaimer: This report is for information purposes only, not for legal, business, or financial decisions. It’s based on the latest available information on the publication date - that information may have changed by the time you read this report. Use it at your own risk.