Machines that Make Machines

Supply chains move fast, let’s catch up and get ahead: strengthening semis supply chains; retail inventory increases unabated; tackling expensive EV materials; Japan’s hidden trade stagnation.

Semiconductor Equipment Exports Power Up

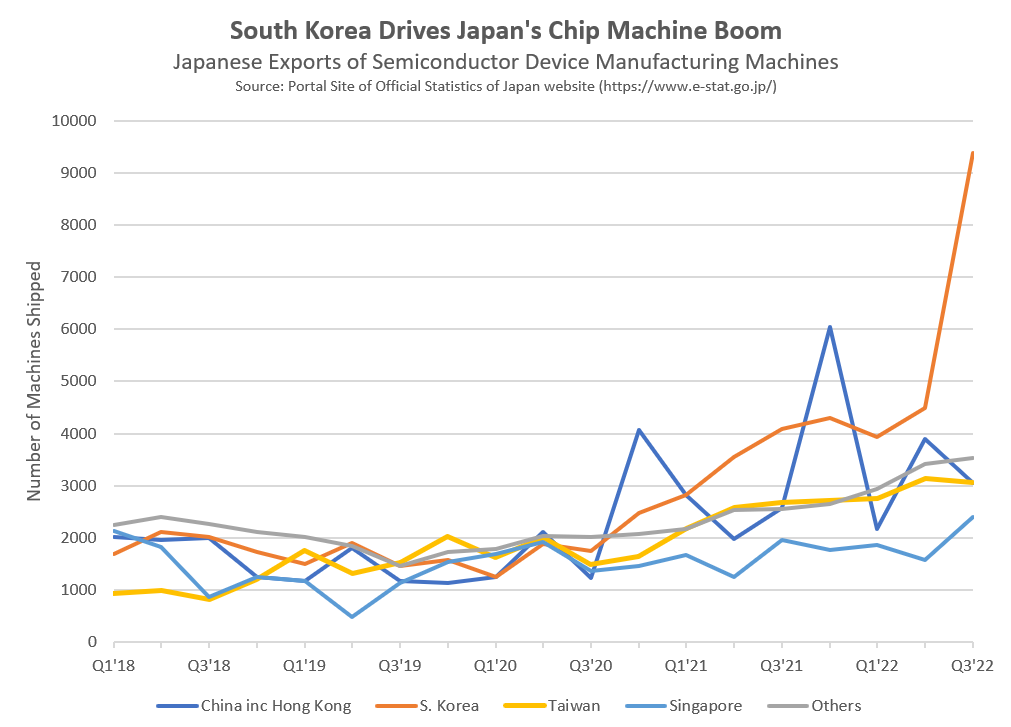

The U.S., Japan, and South Korea will coordinate to strengthen their supply chains, including government spending on developing the semiconductor industry. While much of the focus has been on semiconductors themselves, access to the latest semiconductor manufacturing kit is vital for reshoring strategies. The machines that make semiconductors will be at the heart of spending on such strategies.

As shown in the chart above, there’s been a boom in exports from Japan in 2022. Shipments to South Korea, where manufacturing is dominated by memory and storage devices, climbed to 35% of the total in 2022 from 22% in 2018, soaring 108% in Q3 vs. Q2 after significant deliveries in July. Total exports in Q3’22 reached 21,412 machines, the most since at least 2018 and 30% more than in Q2’22.

They’re also at the heart of rivalry between the U.S. and China. Shipments to China, including Hong Kong, accounted for 18% of exports of semiconductor machinery from Japan in 2022 through Sept. 30, down from a peak of 21% in 2018. Exports in Q3’22 were 21% lower than in Q2, perhaps indicating reduced demand for new investments in the PC and communications sectors (see more below).

Retail - Stocking Levels Pulled Up

U.S. business inventories increased by 0.4% in September versus August. Sales meanwhile only increased by 0.2%, leading to an inventory-to-sales ratio of 1.33x, the highest since February 2021.

The retail inventory-to-sales ratio - excluding autos - reached 1.17x, the highest since May 2020. The autos sector, which has been beset by supply chain challenges, recovered to 1.51x, the highest since February 2021.

Preliminary data for retail sales increased by 1.3% in October vs. September. While the sales were flattered by a 4.1% rise in gasoline sales, sales ex gasoline still rose by 0.9%. Sales by electronics, leisure and department stores fell while furniture, building supplies and nonstore (e-commerce) all improved.

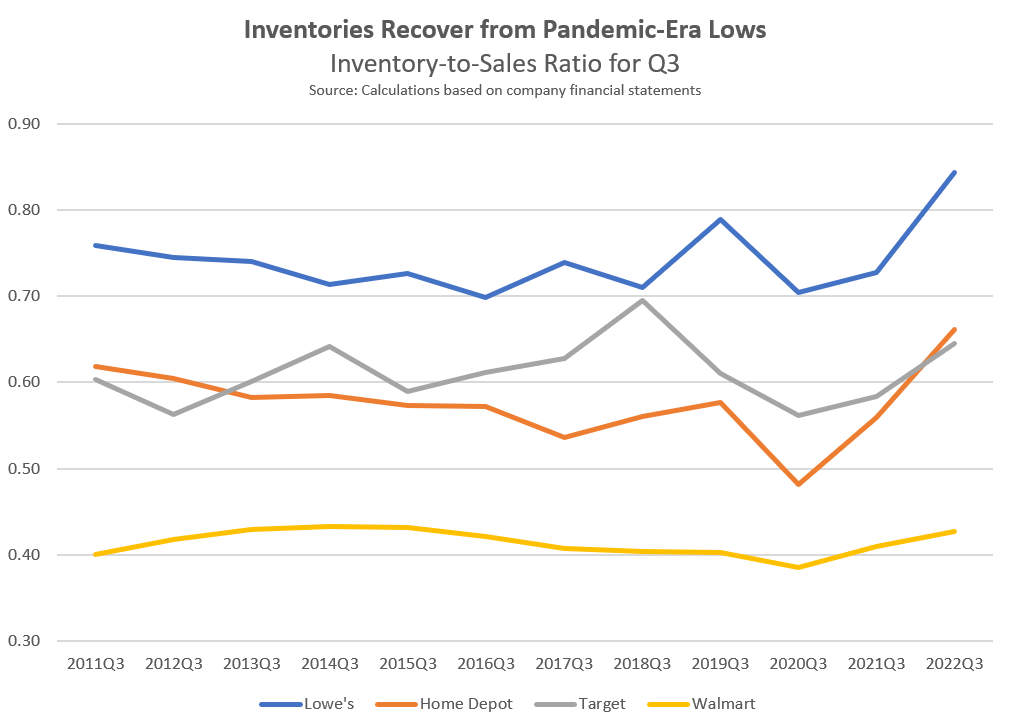

Corporate inventories are increasing for different reasons. The chart above shows the inventory-to-sales ratio for four major retailers based on their latest quarterly data. All are well above pandemic-era lows, while the home improvement retailers are at their highest since at least 2011.

Multiline retailer Target reduced its sales growth expectations to a “low single digit percent decline” for Q4, the key holiday sales season. The firm indicated it may need to make “more markdowns to make sure we accomplish” the goal of reducing its inventories - which reached 0.65x sales in Q3 - by the end of the holiday season.

U.S. hardware retailer Home Depot reported revenue growth of 5.6% year over year in Q3’22, though customer transactions fell by 4.3%. Inventory growth of 25%, due to “strategic decisions in response to continued global supply chain disruption”, left the firm’s inventory-to-sales ratio at 0.66x, the highest since Q1 2011.

Lowe’s headline inventory increased by 19% due to “inflation and higher freight costs”, while “units (were) roughly flat.” Nonetheless, its inventory-to-sales ratio was 0.84x, the highest for Q3 since at least 2011. The firm expects “inventory to build over Q4 with early ordering” to meet spring product demand.

Walmart raised its sales guidance after increasing market share among higher income customers, aided by higher in-stock levels. Walmart’s inventory-to-sales ratio of 0.43x was the highest for Q3 since 2015, after the firm was “too heavy in some general merchandise categories.” The company will become “more aggressive on on shorter lead time items like food and consumables.”

Cutting inventories can involve costs beyond price reductions. Profit margins at battery maker Energizer fell in Q3, in part due to “operating inefficiencies related to reduced production volumes as we lowered overall inventory levels on hand.” The firm is launching an efficiency program which will include $100M in working capital improvements,

Kitchenware supplier Williams Sonoma reported a 2.2% point drop in its operating profit margin “driven by higher shipping and freight costs.” While inventories increased, suggesting reduced supply chain challenges, the firm still faces order backlog and “continue to anticipate our backorder levels will remain elevated in the first half of '23.”

Technology - PC Hangover

There’s been another slew of downbeat commentary from chipmakers and their suppliers in the past week, primarily centered on demand for consumer devices.

Chinese chipmaker SMIC has stated that some U.S. customers are “hesitant” about placing orders. It has also flagged that business in its core sectors are poor and it “currently see(s) no end to the correction to this down cycle, especially as mobile phone and consumer electronics demand is still very weak.”

Memory chip supplier Micron cut its expectations for new wafer starts by 20% for Q4’24, with an expectation of a decline for DRAM supplies in 2024 and less than 10% growth for NAND (both are types of memory chip).

Processor specialist Nvidia reported a drop in sales due to “adapting to the macro environment, correcting inventory levels.” That followed a drop in demand for graphics cards, including a 51% drop in gaming demand. The firm will “continue to work through the channel inventory correction” in the coming quarter.

Chip assembler K&S noted it “continues to anticipate a period of capacity digestion for its high-volume assembly solutions over the coming quarters” due to “a combination of macros and industry-related factors.”

Applied Materials expects its revenues in the coming quarter to dip slightly from the current quarter due to the “impact of recently announced U.S. export regulations and ongoing supply chain challenges.” The latter includes “metals disposition” but the firm has noted that “our supply chain and manufacturing output are incrementally improving.”

Network equipment specialist Cisco is also experiencing an “easing supply situation,” supporting an increase in its earnings guidance. The firm sees component availability improving across the industry, though it also went through a “redesign of many of our products has also helped bring supply stability.”

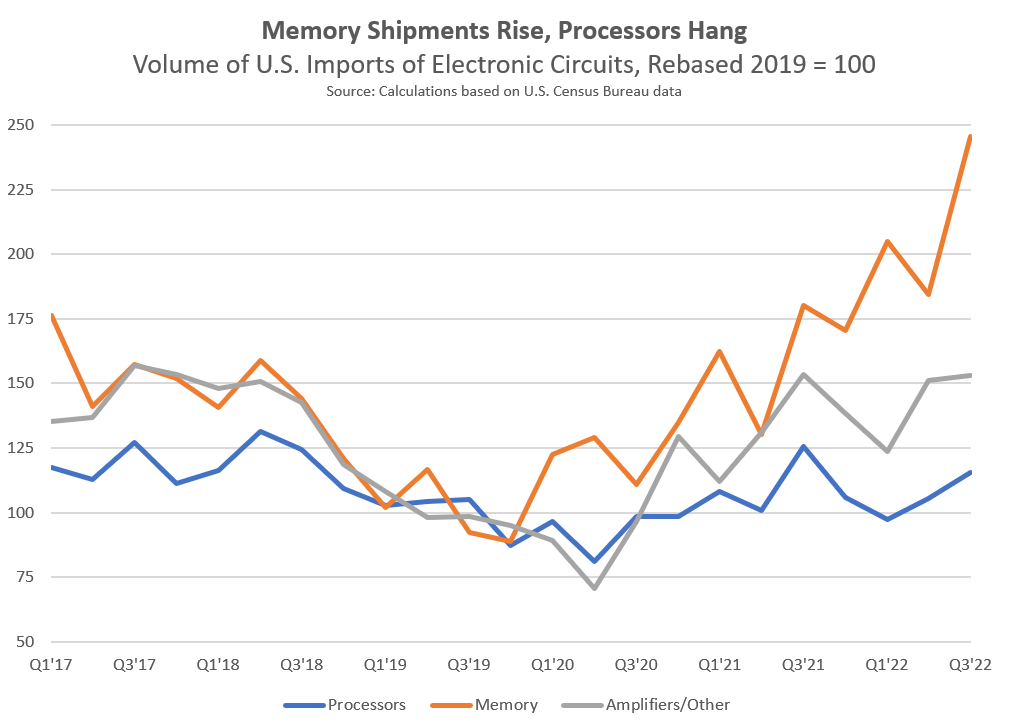

Sourcing of chips has slowed - shown in the chart above - with the volume of U.S. imports of processors and other chips excluding memory down by 7.9% and 0.2% year over year respectively. Shipments of memory chips, meanwhile, have shot ahead with a 36% increase. The latter may reflect increased demand from data-center users and contrasts with Micron’s comments.

Apple will reportedly start sourcing more semiconductors from the U.S. from 2024. That’s part of a global diversification strategy, with the firm stating “60% coming out of anywhere is probably not a strategic position.”

Industrials - Expensive EV Materials

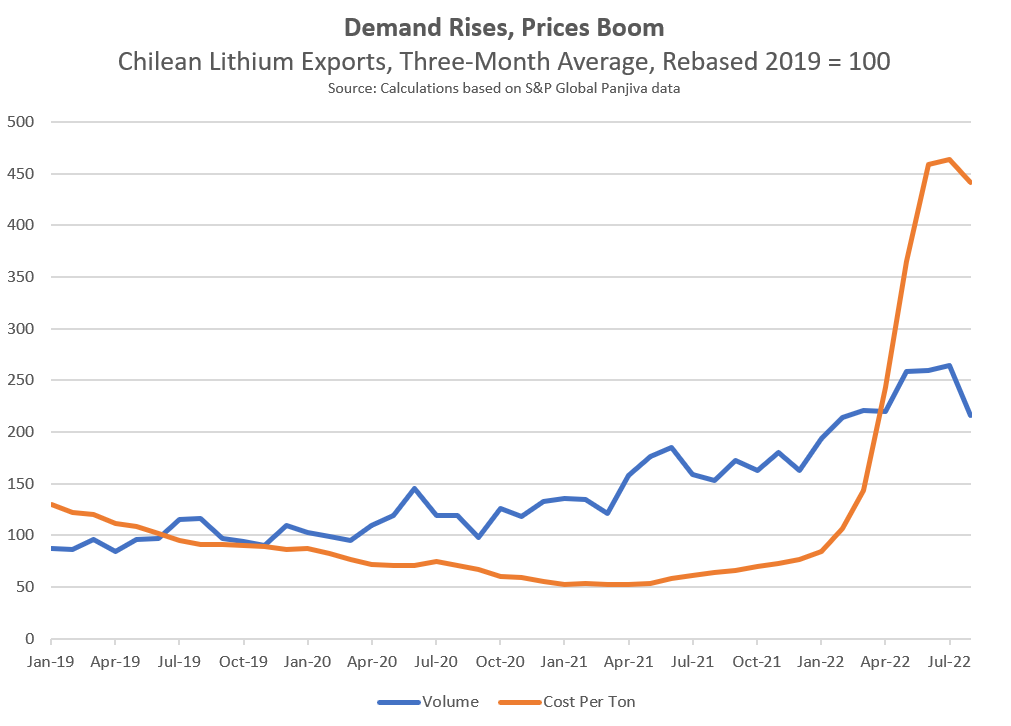

Chilean lithium miner SQM expects global demand for the battery metal to increase by 40% year over year in 2022. Delays in other firms’ plans to bring new production online mean the firm “believes that the supply/demand balance will be tight for the rest of the year, and that the high price environment could continue for the remainder of 2022 and into 2023.”

The chart above shows Chilean exports of lithium, including SQM and Albermarle, climbed 42% higher year over year in the three months to Aug. 31, 2022. The average price per ton exported meanwhile surged 582% over the same period.

BMW is expanding its electric vehicle battery production in China with a $1.4B investment. The batteries will likely be used as part of in-market, for-market production strategies for vehicles to be sold in China.

The expansion of the major automakers into battery production is also driving demand for a wider range of battery chemistries including those based on iron, sodium, and sulfur. That’s partly due to the inherent cost and efficiency considerations, as well as the availability of raw materials.

As the industry matures, battery recycling as a source of materials will become more important. Panasonic has recently signed a recycled cathode deal with Redwood Materials for the former’s new U.S. factory, which is scheduled to come online in 2025.

Italian utility Enel may build a solar panel factory in the U.S. to support its power generation strategy. The plant could produce 3 gigawatts of panel capacity per year (GW/a) and would include the only solar cell manufacturing facility in the U.S. Cells are the main power-generating modules that are bound together to make panels.

First Solar will build a panel factory for its thin-film technology in Alabama, spending around $1.1B for a 3.5GW/a facility. That provides details for a plan first announced in August.

The IEA estimates that Russian oil sales will fall by 1.1 million barrels of oil per day (MBOE) as a result of forthcoming EU sanctions. That compares to sales in September which the IEA estimate to be 7.7 million MBOE. EU sanctions were originally announced in March, and have so far led to a realignment of global oil flows.

Global food prices were broadly unchanged in October, according to the latest UN FAO data, and are still only 4% below February’s peak. Cereal prices have increased to their highest since June, reflecting concerns about the security of supply from Ukraine.

The data for October likely doesn’t include the impact of the Ukraine-Russia-Turkey grain transportation deal being renewed for a further four months. The deal, which ensures the safety of grain shipping through the Azov and Black Seas, has been key in reducing grain prices since the war in Ukraine began.

Food trader Cargill expects cereal and oilseed prices to continue to fall in 2023. There are caveats though, including the assumption that harvests are in line with historic averages.

Container shipping rates for exports from China have fallen for 21 straight weeks, and are now at their lowest since December 2020. China-U.S. west coast rates are at their lowest since September 2020. For context, though, the global ex-China rates are still double their 2019 average level.

Cargo Owners for Zero Emissions Vessels” group of 19 firms will launch a “competition law compliant process” for joint purchasing of zero emissions ocean shipping. Members include Amazon, Ikea, Philips and Unilever. Thus far the plans are only at the “roadmap” stage.

Politics and Economics - It’s Good to Talk

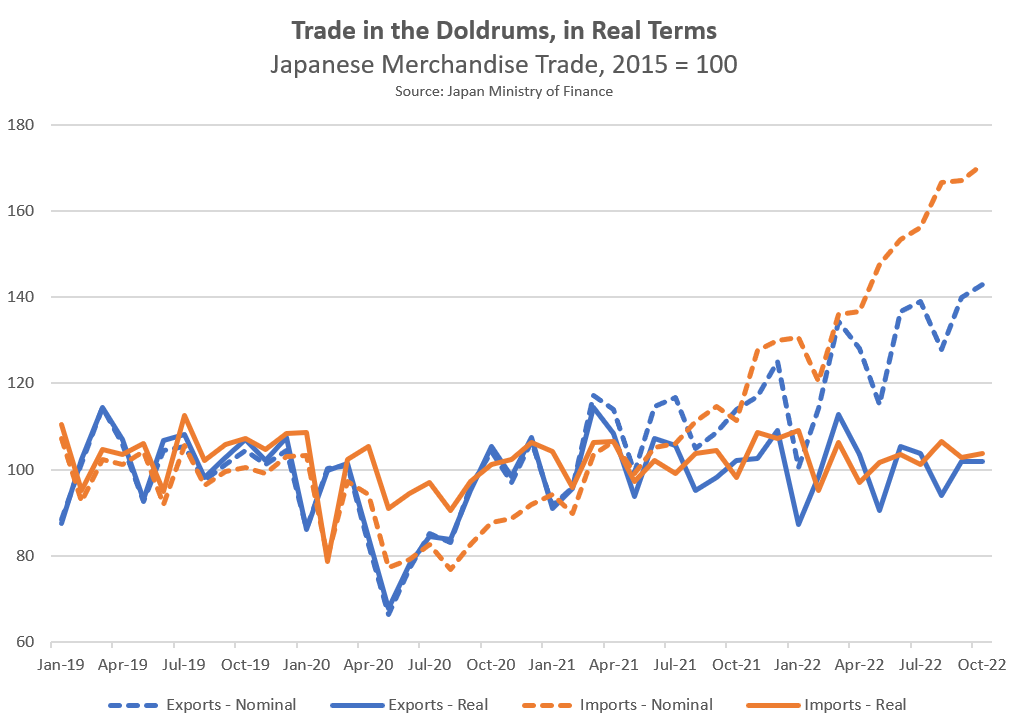

Japan’s merchandise trade increased by 39.5% year-over-year in October. As shown in the chart above, however, that was largely down to elevated commodity prices. Exports in real, i.e. inflation-adjusted, terms fell by 0.4%, the eighth decline on that basis in 2022. Imports meanwhile rose by just 5.6%.

In real terms, exports of semiconductors fell by 4.6% and computer parts declined by 9.3%, matching the broader downturn in the technology industry noted above.

The main result from a meeting between President Xi and President Biden is a commitment to continued talks. The official U.S. readout makes oblique reference to concerns about non-market economy actions, which is the basis of the long-standing Section 301 tariffs.

A commitment to a visit to China by Secretary of State Blinken in 2023 would suggest security matters, rather than economics, are likely to be the official focus.

China has reportedly eased its COVID-19 restrictions, in part as a response to the economic costs of supply chain disruptions.

The European Union has committed to extending its greenhouse gas emission reduction target to a 57% cut in 2030 from 1990 levels from 55%. The implementation of that extension may require a review of a wide-range of policies, including the umbrella “Fit for 55” program which features the Carbon Border Adjustment Mechanism and rules for shipping and airlines.

China’s government plans to invest in new coal-fired power generating equipment to improve security of supply in the face of higher gas prices. The government insists, however, that it doesn’t represent a move away from its stated emissions reduction plans.

Indonesia has struck a deal with the EU, Japan, U.S. and others worth $20B to assist in transitioning the country’s power generating mix away from coal. South Africa has received a similar deal, while Vietnam is reportedly in similar negotiations.

Ireland’s ratification of the EU-Canada trade deal has been held up by the Irish Supreme Court. The rejection is based on single part of deal and can be resolved by act of parliament. It nonetheless illustrates the complexity and time taken to complete such deals - CETA came into force in September 2017.

The latest U.K. budget includes tariff suspensions on 100 products, ranging from food to bicycle parts, for two years. The move forms part of the government’s strategy to address cost-of-living issues and is worth £160M per year according to Treasury estimates.

Final Fun Fact: The G20 declaration this year includes 10 mentions of “supply chain”, up from six at the Rome meeting in 2021 and just one from the 2019 Osaka meeting.

Disclaimer: This report is for information purposes only, not for legal, business, or financial decisions. It’s based on the latest available information on the publication date - that information may have changed by the time you read this report. Use it at your own risk.