Falling Forward

Supply chains move fast - let’s get ahead: forwarders’ volumes, and margins fall; green policy disagreements; Apple and Nintendo cut output; inflation slows in the U.S., deflation in China.

November 15, 2022

Chart of the Week - Freight Forwarding Q3’22 Wrap-Up

The Q3’22 reporting season from the freight forwarding sector wrapped up last week and showed lower volumes and reduced profit margins.

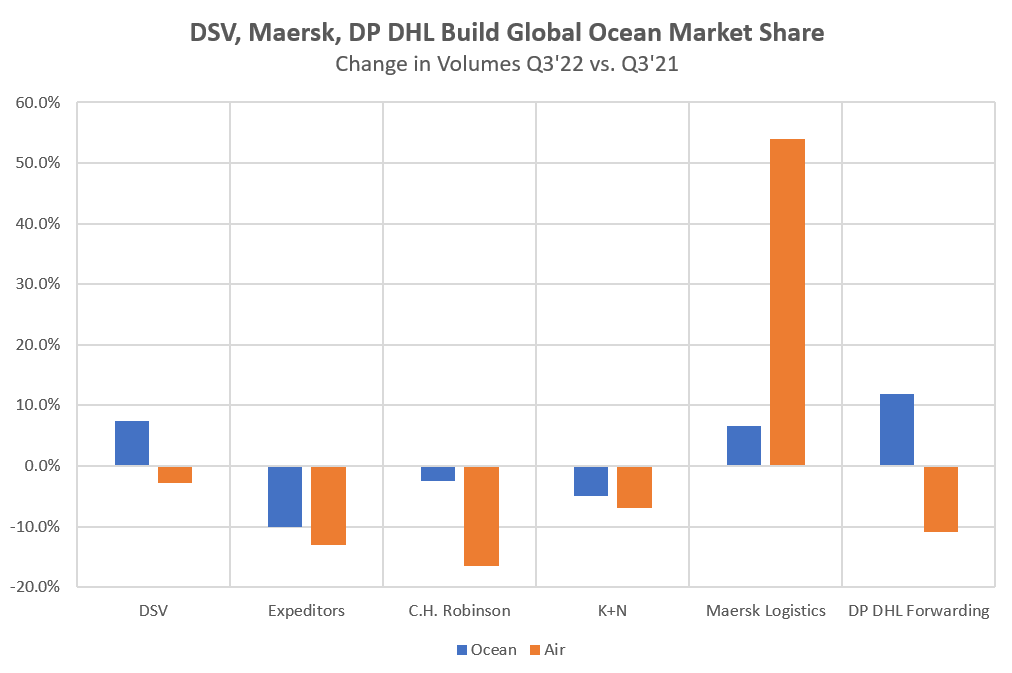

Company financial statements show a significant divergence in global volumes handled/ DSV, Maersk’s Logistics division and DP DHL’s Forwarding operations all expanded their ocean volumes handled. Growth at Maersk, which also was the only major forwarder to increase airfreight volumes, is driven by its significant market share ambitions.

Data for U.S. seaborne imports showed that eight of the top 10 forwarders experienced lower volumes versus a year earlier in October, and all are below their May peak by an average of 17%.

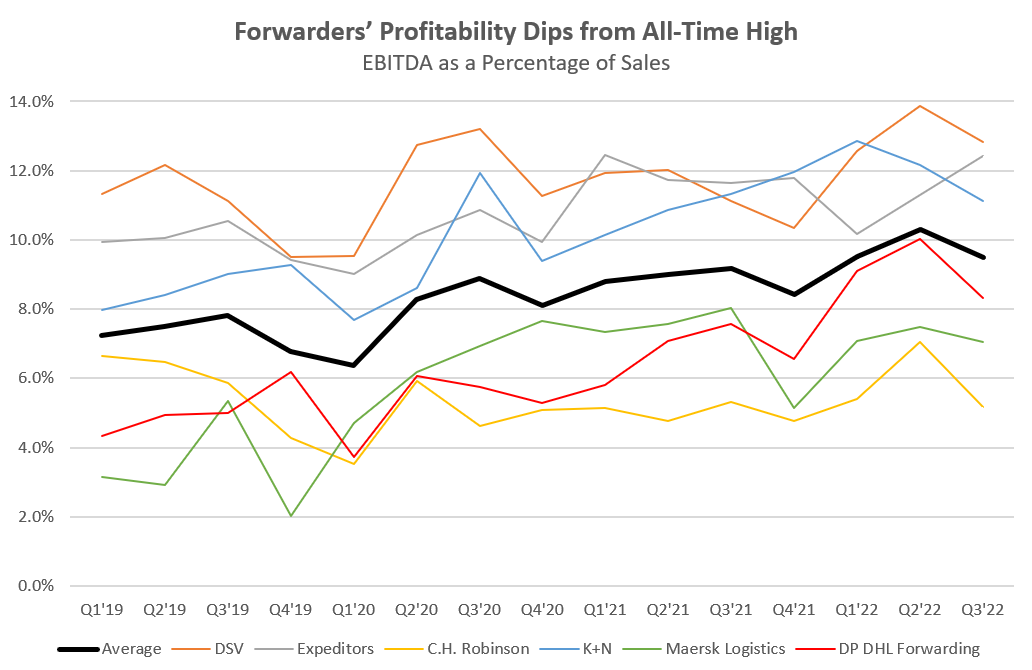

The impact of competition can be seen in profit margins. Expeditors saw the biggest decline in volumes but it was the only firm to increase its profitability quarter-on-quarter in Q3’22 at the EBITDA line. Total margins for the group, shown in the black line above, dipped to 9.5% from 10.3% in Q2. That was still in line with Q1’22 and therefore the second highest on record.

Notable comments from the firms’ earnings filings and conference calls include:

DSV will “continue to be negatively impacted by the slowdown in the global economy”. It also noted that “uncertainty concerning the macro environment and the global logistics market remains high, and changes to the outlook may occur.”

Expeditors has experienced “decelerating demand and an overall decline in rates are likely to continue for the remainder of 2022 and into 2023.”

CH Robinson is now focused on a cost-cutting plan as well as “driving market share gains and growth.”

K+N provided no firm outlook, but has noted from a competitive perspective that it is “focusing on product mix and yield management”

Maersk has lowered its “outlook for the growth of 2022 global container demand to between -2%/- 4% decline from previously the lower end of the +/- 1% range”. Over the longer term, the firm is committed to growing Logistics to a similar scale as Ocean.

DP DHL stated “Crises are moments where strong players take advantage, and we’ll be stronger than competitors going forward”

Environment & Emissions - COPs and EVs

The UNFCCC COP27 last week and this week is mostly focused on mitigation funding, with little new in the way of supply chain policies. Existing national policies are causing controversy though, particularly the U.S. Inflation Reduction Act, which includes support for electric vehicles and renewables manufacturing.

The European Union, Japan, and South Korea have all expressed dissatisfaction with the Act. The countries and the WTO are concerned they represent a restriction on trade. South Korean battery makers have also cited specific concerns in filings with the IRS.

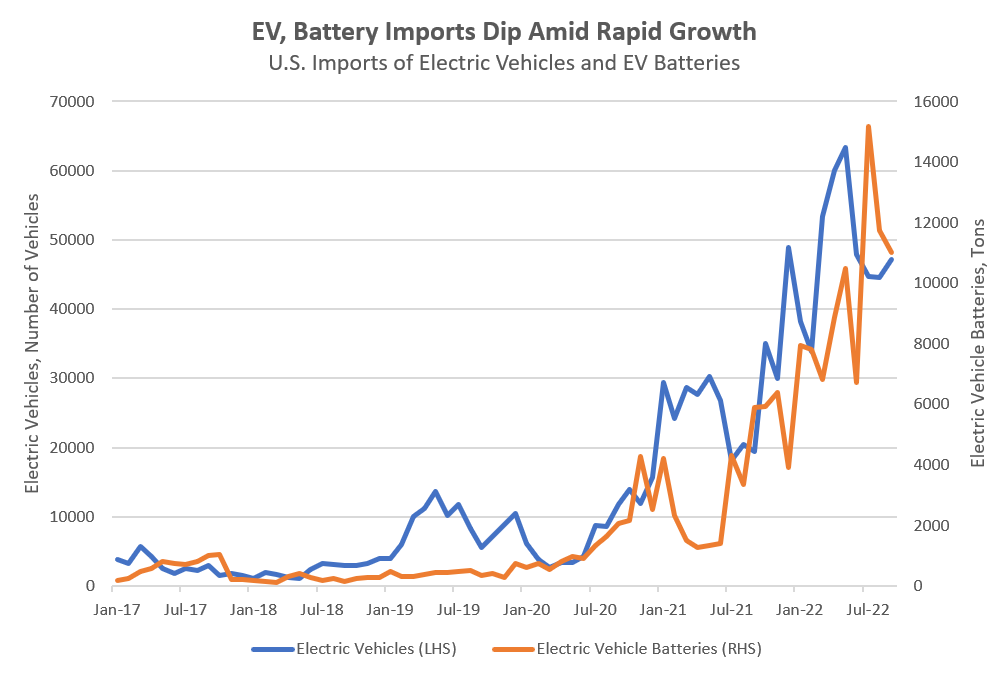

U.S. imports of electric vehicles fell in Q3’22 versus Q2’22 by 20%, as shown in the chart above. Shipments of batteries meanwhile increased by 45%. While that may suggest more domestic production, short-term supply chain restrictions may also be playing a part.

The European Union Parliament and European Council (heads of state group) reached an agreement on greenhouse gas emissions reductions for sectors not already covered by the Emissions Trading Scheme. That includes road, maritime transport, buildings, agriculture, waste, and smaller industries.

The “First Movers Coalition” group of manufacturers announced it has expanded to 65 companies. The group now covers 30% of global GHG emissions across aluminum, steel, aviation, shipping, trucking, and CO2 removal technologies.

U.S. Customs and Border Protection have blocked imports of 1,053 shipments of solar panels from China, under Uyghur Forced Labor Protection Act. Firms affected reportedly include Longi Green Energy, Trina Solar, and JinkoSolar.

Technology - Nintendo and Apple Hit Snags

Videogame producer Nintendo has cut its forecast for FY23 (to March 31) sales of Switch consoles by 10% to 19 million units. That reflects year-to-date shipments, even though there is a “gradual improvement in the procurement of semiconductors and other components.

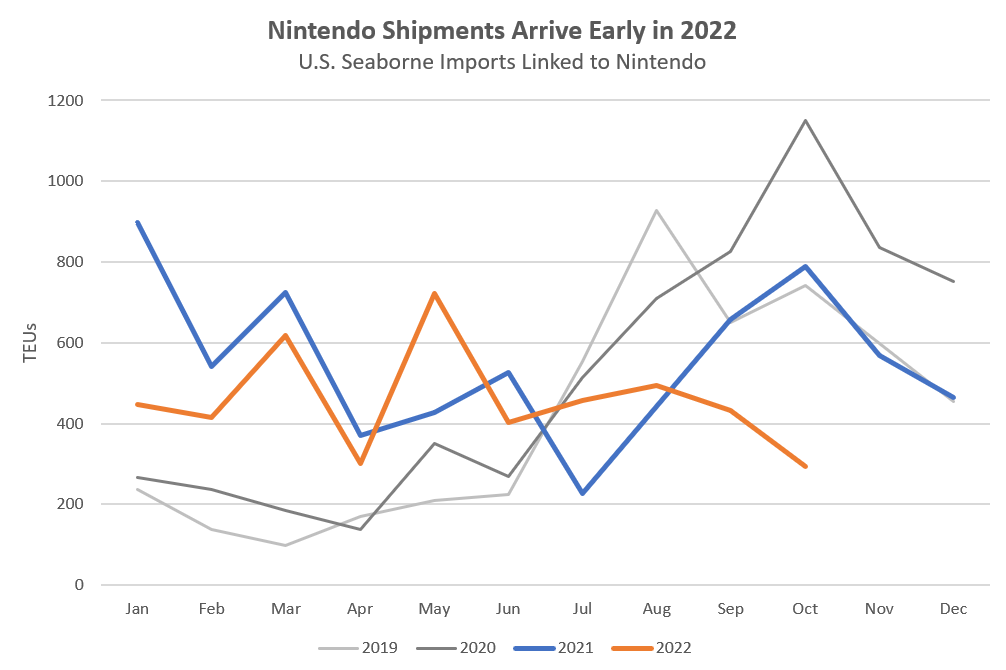

U.S. seaborne imports of Nintendo-related products, shown in the chart above, increased by 4% year over year in Q3’22 after rising by 8% in Q2. A marked drop in October may reflect importers having completed their purchases early, which has been a common theme among toy retailers in 2022.

Apple confirmed that factory closures in Zhengzhou, China will restrict the availability of the iPhone. The restrictions look set to continue in Zhengzhou, while there are indications of lockdowns and movement restrictions expanding in other regions too.

Preliminary trade data for China (see more below) indicates exports of mobile phones fell by 11% year over year in October and by 25% compared to the same period in 2019.

The governments of Japan and the U.S. have launched a 350 billion yen semiconductor research collaboration. A tangible sign of development can be seen in IBM’s plans for the joint development of next-generation chips with Rapidus, a Japanese government- and corporate-backed semiconductor developer.

The German government has blocked the sale of two chip manufacturing plants to Chinese buyers, citing concerns about technology know-how flows to firms outside the EU.

The governments of China and Vietnam plan to “jointly build a stable system of industrial and supply chains.” China will encourage “ technology-intensive enterprises with strength and good reputation to invest in Vietnam.”

Semiconductor delivery times have reportedly fallen to 25.5 weeks in October from 26.3 weeks in September. That’s still only a little below the 27 week peak in April and well above the pre-pandemic range of 13 weeks to 15 weeks.

Semiconductor equipment manufacturing specialist ASML expects “the predictability of the move rates in the supply chain improving.” It has increased its 2025 revenue target to around $35 billion from $27 billion “assuming we will have addressed the supply chain issues in the coming quarters.”

Tokyo Electron meanwhile has downgraded its earnings guidance for the current year, citing the impact of U.S. restrictions on sales to Chinese semiconductor equipment buyers.

Chipmaker Nvidia has developed a version of its A100 data center processor specifically for the Chinese market. The A800 has the same processing power, but lower communications speeds which limit its uses for supercomputing. Such uses are at the heart of existing U.S. restrictions on exports of semiconductors to China.

TSMC has secured alternative sourcing of neon for its semiconductor manufacturing from Taiwan, having previously relied on sourcing from Ukraine. The firm has also announced the construction of a second fabrication plant in the U.S., presumably helped by CHIPS Act funding.

Consumer Goods - Early Toys, Less Inflation

The National Retail Federation expects a marked downturn in U.S. seaborne imports of consumer goods in the coming months. Shipments are expected to fall 9% year over year in November and December, with an acceleration to a 15% decline by March. Excess corporate inventories, partly reflecting earlier-than-normal shipping, are blamed for the slowdown.

Toy maker Spin Master reported a 13% drop in revenues in Q3’22 as “retailers brought in goods earlier this year to avoid anticipated supply chain disruptions in the fall.” As shown in the chart above, U.S. seaborne imports linked to the firm fell by 9% year over year in Q3’22, with the decline accelerating to 61% in October.

The U.S. Consumer Price Index increased by 7.7% on a reported basis versus a year earlier and rose by 6.3% excluding food and energy. Both were lower than a month earlier and below economists’ expectations.

CPI included lower medical costs, which reflect the government’s calculation methodology rather than reduced pay rates. Cardinal Health has stated it has been increasing prices to offset higher costs.

EU retail sales increased by 0.4% on a real, i.e. inflation-adjusted, basis in September versus August, with nonfood sales rising by 1.0%. That equated to sales being unchanged versus a year earlier after three months of declines. Extensive discounting by retailers may have been a driver. Nonfood sales were also 9.3% above the same period in 2019.

The improved sales came despite retail gas and electricity bills reaching a record high in September and October. Unit costs for electricity were 64% higher in October than a year earlier while gas doubled.

British retailer Marks & Spencer reported higher sales in the first half of its fiscal year in food, apparel and home goods. It nonetheless warned a “gathering storm” of higher energy and interest costs will cut consumer spending later in the year.

Adidas expects 2023 to continue to have a “challenging market environment” and is therefore implementing “several initiatives to mitigate the significant cost increases resulting from the inflationary pressure across the company’s value chain.”

Hanesbrands expects Q4’22 revenues to fall by 15% year over year on a currency-neutral basis, accelerating from a 3% dip in Q3’22. The firm cites a “macro-driven slowdown in consumer spending … with the impact to orders as U.S. retailers tightly manage their overall inventory levels.”

Sneaker brand owner Wolverine World Wide expects revenue growth of 2% to 6% in Q4’22 due to “a heavily promotional environment.” As such the firm is “prioritizing the liquidation of non-core inventory over the coming months.”

Industrials and Logistics - Producers Deflate, Autos Stutter

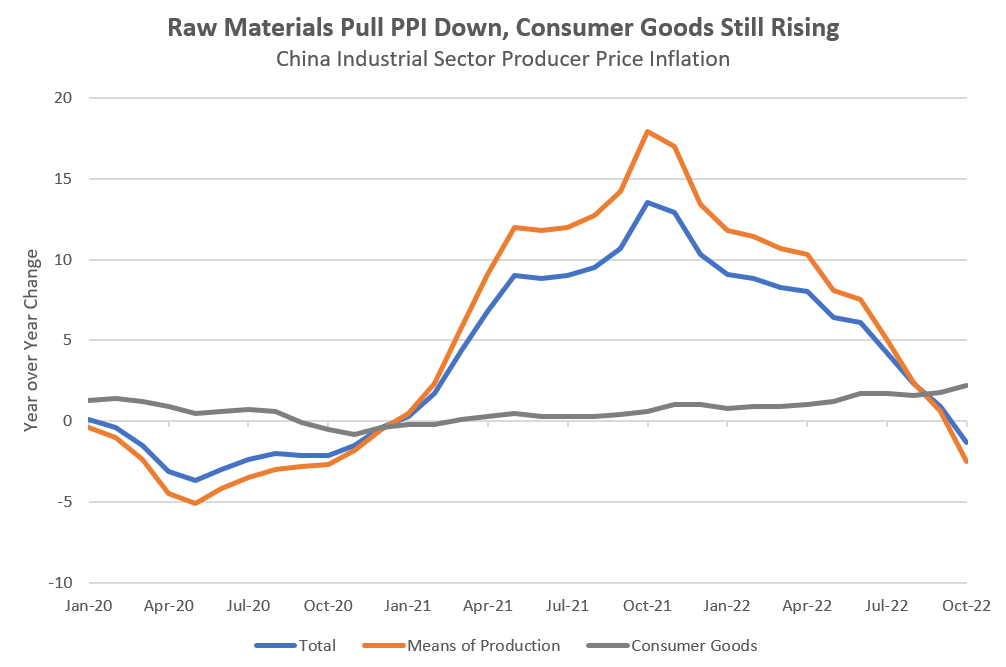

China’s Producer Price Index fell by 1.3% year over year on a headline basis in October, the first decline on that basis since December 2020, as shown in the chart above. Lower metals costs led the way, with iron and steel down by 12.3% and nonferrous metals off by 4.9%. The PPI for consumer goods continued to accelerate, reflecting higher food and technology costs.

Auto parts maker Magna reduced its revenue guidance for 2022, citing “continued supply constraints”, which are lasting longer than expected, as the impact of “high inflation and rising interest rates on consumer demand.” The firm also expects vehicle production in late 2022 in Europe and North America to be below July’s levels.

Jeep manufacturer Stellantis has paused production at an Italian factory due to a continued chip shortage. While minor in a group context, it’s a reminder that the semiconductor shortage for automakers continues.

Electric vehicle manufacturer Rivian maintained its production guidance for 2022, but stated “we believe that supply-chain constraints will continue to be the limiting factor of our production.”

Recreational vehicle maker BRP increased its revenue guidance for the year, citing “current improvements in supply chain and our additional production capacity”, That followed a quarter marred by “supply chain disruptions” which “limited the Company’s ability … to satisfy consumer demand … and to replenish dealer inventories.”

Demand for Class 8 trucks in the U.S. remains elevated, with FTR data showing orders of 43,200 vehicles in October. While down from September’s peak, it was still well above the 19,000 average of the prior 12 months and inline with the Q1’21 average. Orders taken now will likely only be fulfilled in Q3’23.

Pratt & Whitney owner Raytheon has warned that a shortage of aerospace-grade engine castings will persist during “the rest of this year and into, probably through, most of next year.” That’s requiring the firm to make “trade-offs between our aftermarket needs and delivering for new aircraft.”

U.S. nonfarm payrolls for transport and logistics increased by 8,200 to 6.52 million in October versus September. That was led by a 13,200 rise in trucking jobs. Employment in warehousing fell by 20,000 to 1.74 million positions, the lowest since February and the fourth down-month on a seasonally adjusted basis.

The ongoing strikes at the British Port of Liverpool may be resolved after unions reportedly accepted the port owners’ pay offer. The level of disruptions can be seen in U.S. seaborne imports from Liverpool, which fell by 52% year over year in October to their lowest since at least 2007.

Port Houston will apply a dwell fee for containers following a seven-day free period, starting at $45 per continued and rising to $150. That’s designed to address emerging port congestion. By contrast to the total U.S. port network (see above), volumes of inbound containers to Port Houston were still above year-earlier levels in October.

Global airfreight handling fell by 11% year over year in September. That means it remains 4% below the same period in 2019, according to IATA data.

Politics and Economics - Beyond Recognition

The U.S. government has formally withdrawn its recognition of Russia as a market economy for the purposes of tariff calculations. That represents the formal implementation of a sanction first proposed in March.

The U.S. Treasury has found no governments are currently manipulating their currencies. The semiannual review has removed Vietnam from its “monitoring list”, which includes China, Germany, Japan, Malaysia, Singapore South Korea, and Taiwan. Switzerland will be subject to enhanced analysis.

The European Commission has backed away from a natural gas price cap and instead may prefer market limits to prevent price spikes. The lack of a widespread cap led to a resurgence in natural gas prices during the week.

The EC proposal will also look for unified ways to spread elevated costs for consumers over time. The German government has provided details of an 83 billion euro package to subsidize electricity and gas costs for consumers.

The EU and the U.S. have reaffirmed their commitment to increase shipments of LNG from the U.S. to the EU as a response to the loss of supplies from Russia. That will include “the establishment of the EU energy platform as an instrument for demand aggregation and joint purchase of gas.”

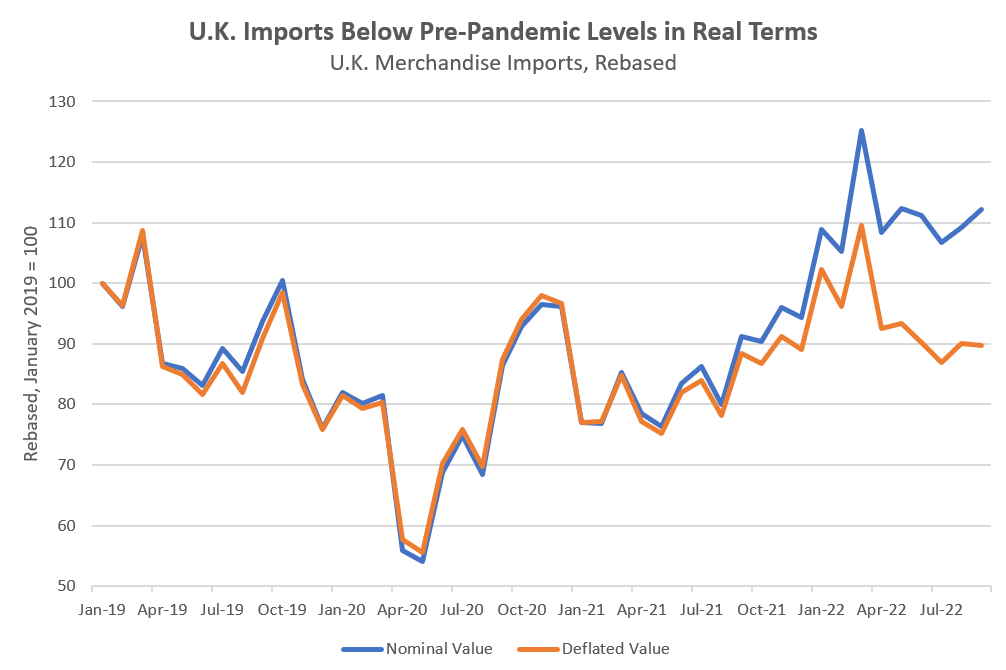

U.K. imports climbed by 23% year over year in September. Imports of natural gas led the way, accounting for 34% of the total increase in sterling terms after growing by 275%. Automotive imports also rose by 42% as the industry recovers from supply chain-related issues.

Import price inflation, particularly in commodities, has been the main driver of import growth over the past year. On a real, i.e. inflation-adjusted basis, imports rose by just 1.6% year over year. That left imports 0.4% below September 2019 and 10% below January 2019 levels in real terms, reflecting the pressures faced by the logistics industry.

Chinese exports fell by 0.4% year over year in October, underperforming economists’ expectations of a 4.5% increase. Exports of home appliances, computers, and AV equipment fell by 14% to 25% in dollar terms. Furniture and clothing shipments dropped by 11% and 17% respectively, indicating a weakness in consumer-related exports.

Taiwan’s exports also declined, by 0.5%, in October. While exports of electronic components increased by 16%, exports of base metals, plastics, and chemicals fell by 19% to 29%.