‘Tis Normally The Season

Supply chains move fast - let’s get ahead! This week we’ll speed up and diversify toy and electronics sourcing, hang up on Chinese telecoms, use policy to drive oil flows & preview EU-U.S. tech talks.

Seasonal Supply Chains - Speedy and Shifting

Did toy and electronics retailers change their sourcing strategies to reduce their execution risks for this holiday shopping season? We’ll show that toy sellers shipped early and boosted inventories, while electronics importers continued to diversify their supply base.

U.S. seasonal shopping appears to be robust. NRF data indicates footfall, in stores and online, rose by 9% year over year over the Thanksgiving weekend. Holiday-related spending increased by 8% according to NRF, while Adobe identified a 6% rise in Cyber Monday sales.

It’s worth noting that underlying inflation may have been offset by discounts. Additionally, there are still a few weeks of spending that could tip the seasonal total lower in volume terms if shoppers have simply spent earlier than normal. (There’s more data later in the report.)

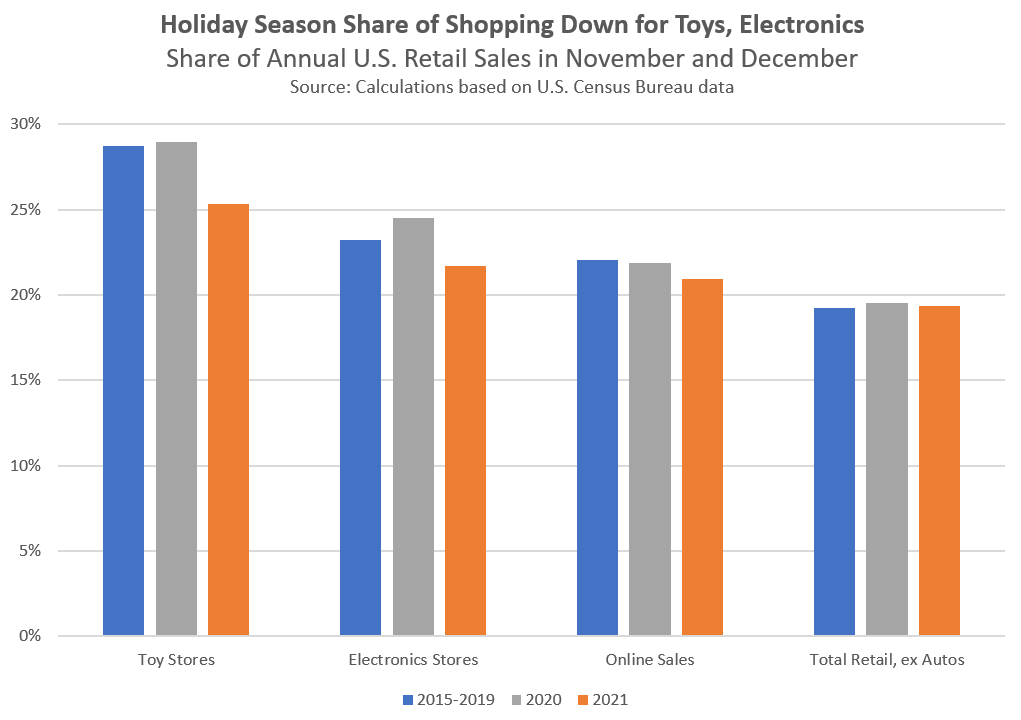

Last week we showed that total retail sales in November and December have historically been 20% more than the monthly average, though seasonality has declined in the past 30 years. As the chart above shows, for the U.S., the seasonal skew is much higher for electronics and toys. That makes successful supply chain operations vital in ensuring sales opportunities are maximized.

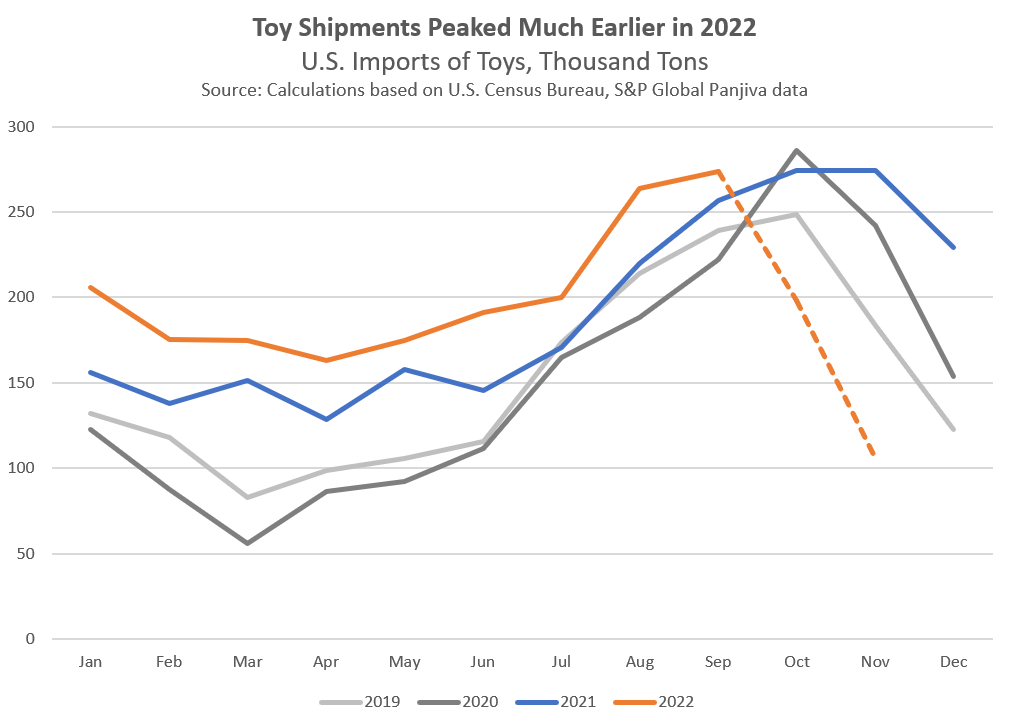

In the toy sector, there is clear evidence, shown in the chart above, of earlier shipping in 2022 than in previous years. The dotted lines in the chart are based on preliminary data for U.S. seaborne imports. They indicate a marked drop-off in shipments in October and November, which are normally peak delivery months, after a more rapid rise during Q3’22.

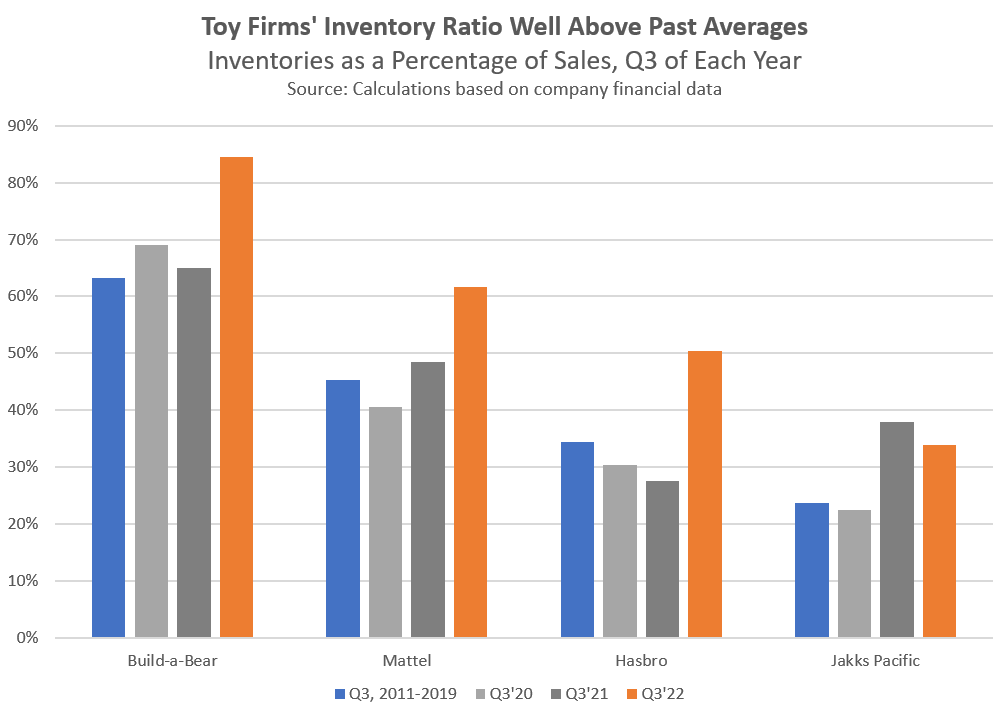

The early shipments have left major toy brand owners and retailers with inventories that are well above historic levels as a ratio of sales at the end of Q3’22, as shown in the chart above. For the four firms shown, the weighted average inventory-to-sales ratio of 55% compares to 38% in Q3’21 and 39% for the 2011 to 2019 Q3 average.

There’s a long arc in sourcing strategies as firms use global supply chains to minimize risk and mitigate costs - whether they be labor- or tariff-related. Logistics challenges including congestion and zero-COVID policies are just the latest factors for procurement decision-makers.

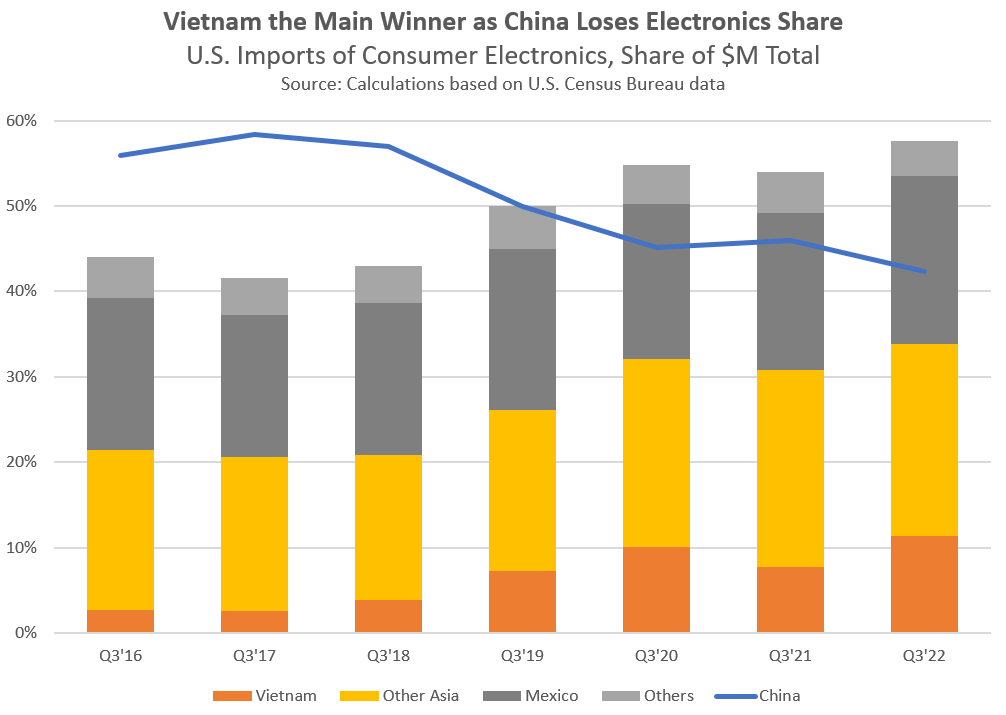

In consumer electronics, shown in the chart above, Chinese suppliers’ share of U.S. imports fell to 42% in Q3’22 from 46% in Q3’21 and 56% in Q3’16. Vietnamese suppliers have been the main beneficiaries, picking up three of the four percentage points of share lost by Chinese shippers in Q3’22 versus Q3’21 and 9% out of the 14% points over the longer term.

The shift in the toy sector is less pronounced, with China’s share of U.S. imports down to 88% in Q3’22 from 89% in Q3’21 and 93% in Q3’16. Vietnamese suppliers were again the winners.

Technology - Hanging Up on China

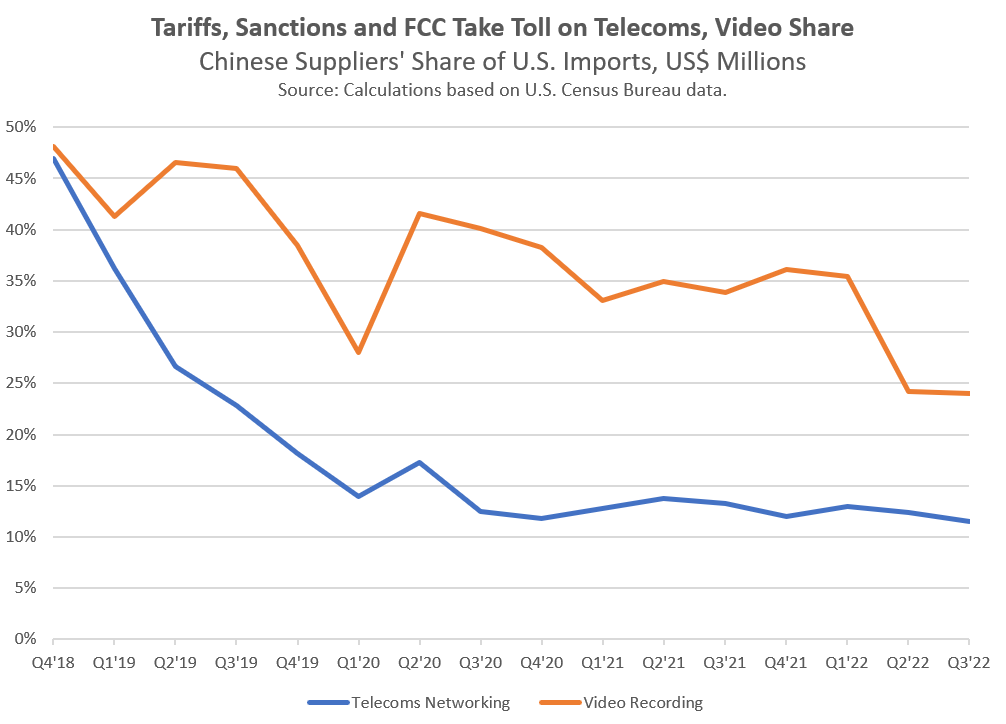

The U.S. FCC has adopted rules to ban the sale of new telecommunications equipment by Huawei and ZTE as well as connected cameras by Hikvision, Dahua Tech, and Hytera Communications, citing data-related national security concerns.

The action continues a range of restrictions on Chinese telecoms and video surveillance equipment in the U.S., including earlier sanctions, tariffs, and FCC rulings applied during the Trump administration.

The earlier actions have already cut Chinese suppliers’ share of U.S. imports. The blue line in the chart above shows the share of U.S. imports of telecoms networking equipment supplied from China. In Q4’19, the first date disaggregated data was available, China had a 47% share. That dropped to 11% in Q3’22.

In the case of video recording equipment, China’s share fell to 24% in Q3’22 from 48% in Q4’18. In the case of both telecoms and video equipment, suppliers from Vietnam and Taiwan have boosted their market share in U.S. imports.

The U.K. government has also banned the use of Chinese-built video systems in government buildings, again citing national security issues. Thus far though it has not restricted the wider sale of such equipment.

TSMC’s new Arizona chip fab, due online in 2024, will provide more advanced semiconductors than originally planned. That’s reportedly due to requests from U.S.-based customers looking to increase their domestic manufacturing.

Global semiconductor sales are expected to drop by 4.1% in 2023 versus 2022 according to WSTS. That will only take the value of shipments back to the 2021 level, however.

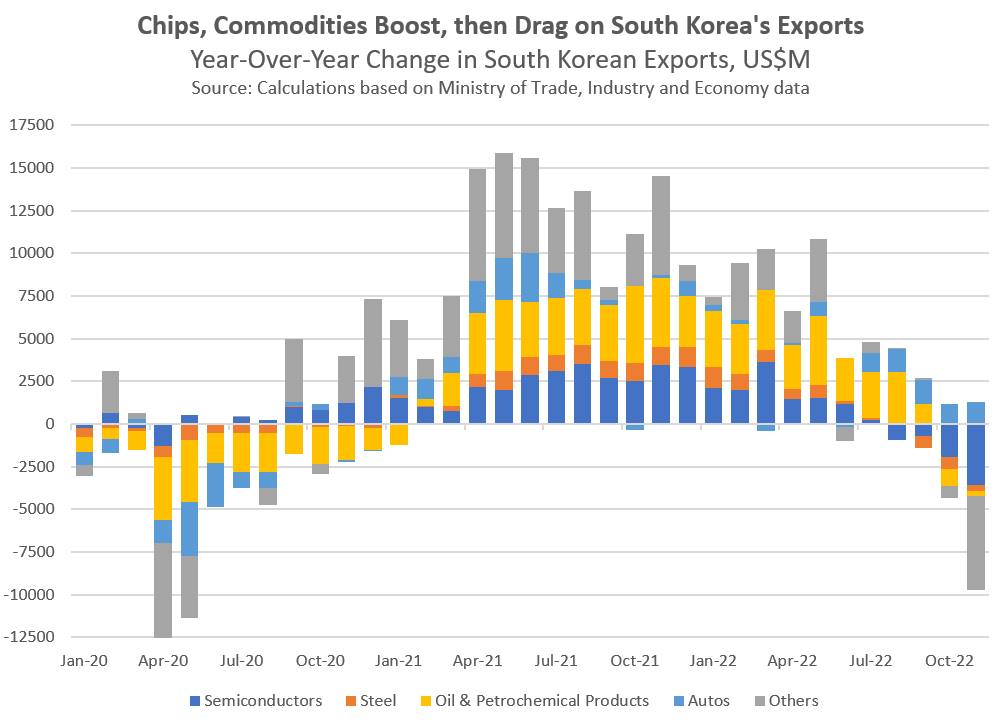

South Korean semiconductor exports fell by 30% year over year in November, marking a fourth monthly downturn. That left exports in dollar terms at their lowest since August 2020. Memory chips accounted for 63% of South Korean semiconductor exports in 2021 according to UN Comtrade data.

Foxconn will increase staff payments to boost retention in the wake of absences linked to COVID-19 closed-loop practices. The recent absences may cut production of Apple’s iPhone by 6 million units in 2022 compared to the planned production of 87 million phones. The shortfall could be made up during the normal off-peak season in the new year.

Commodities - More In, More Out

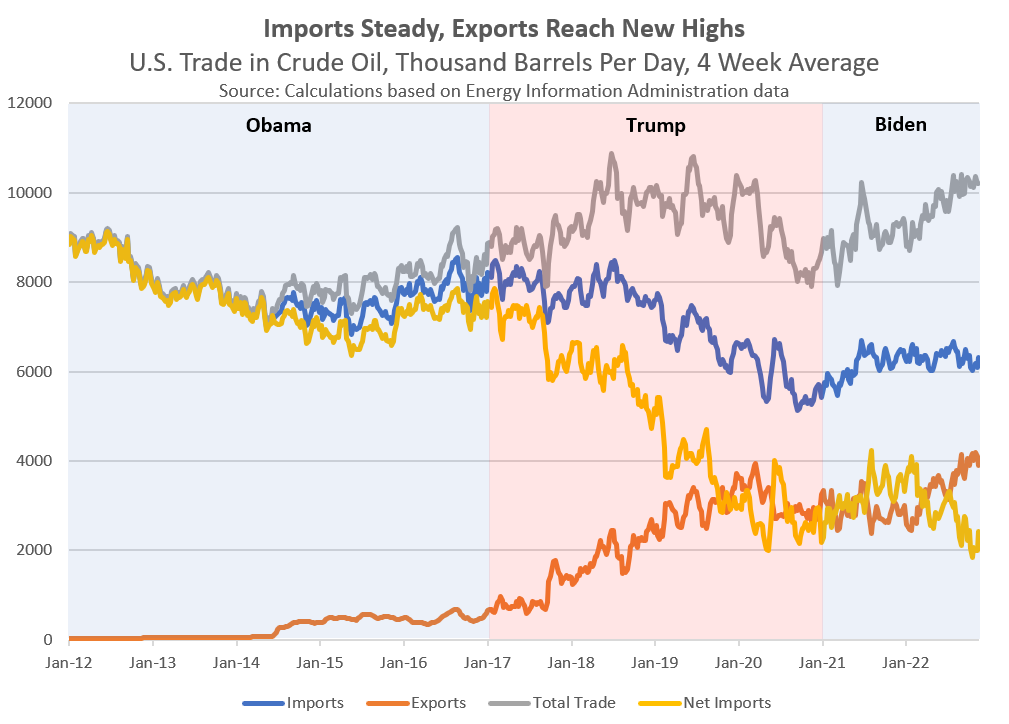

Two new regulatory actions by the Biden administration may increase U.S. cross-border trade in crude oil. First, the U.S. Department of Transportation has approved a new oil export terminal in Texas that could ship two million barrels of oil equivalent per day (2 mboed). Second, Chevron has received a license to resume importing oil from its Venezuelan properties.

The chart above shows total U.S. imports and exports of crude oil combined have increased by 16% year-to-date. Exports have risen by 51% over that period and six-fold compared to the start of 2017. Exports to Europe have replaced those to China in the past year as energy markets realign in the face of the war in Ukraine.

Total imports have declined by 23% versus January 2017 as U.S. production has increased, though they are unchanged year-to-date. Imports are still necessary due to the different grades of crude oil and their usefulness for different refineries.

In Q1’09, imports from Venezuela accounted for 14% of total imports, or 4.1mboed. Shipments might not reach those historical levels given reduced U.S. demand and license limitations allowing investment in existing facilities only.

The EU has provisionally set a price cap for Russian oil exports, with restrictions to come into force on Dec. 4. So far a price of $60 per barrel (Urals crude) is planned, with a review every two months.

Trade flows are already realigning. India has become a significant market for Russian oil and accounted for 40% of Urals-grade export in November.

China plans to increase ties with Russia in energy. President Xi has stated he is looking for a “closer energy partnership, (to) promote clean and green energy development and jointly maintain international energy security and the stability of industry supply chains.”

The outlook for global oil prices also depends on regular supply-and-demand considerations. An OPEC+ meeting on December 4 may choose to review the two mboed cut applied in October. Concerns about demand from China in the wake of new COVID-related lockdowns have weighed on prices at various times in the past week.

ConocoPhillips has signed two new liquefied natural gas contracts with QatarEnergy for delivery into Germany. Deliveries will only start in 2026, underlining the challenges in securing new, long-term contract volumes that the Japanese government previously flagged.

Industrials - EU-U.S. TTC Preview - Tariff Trouble Coming

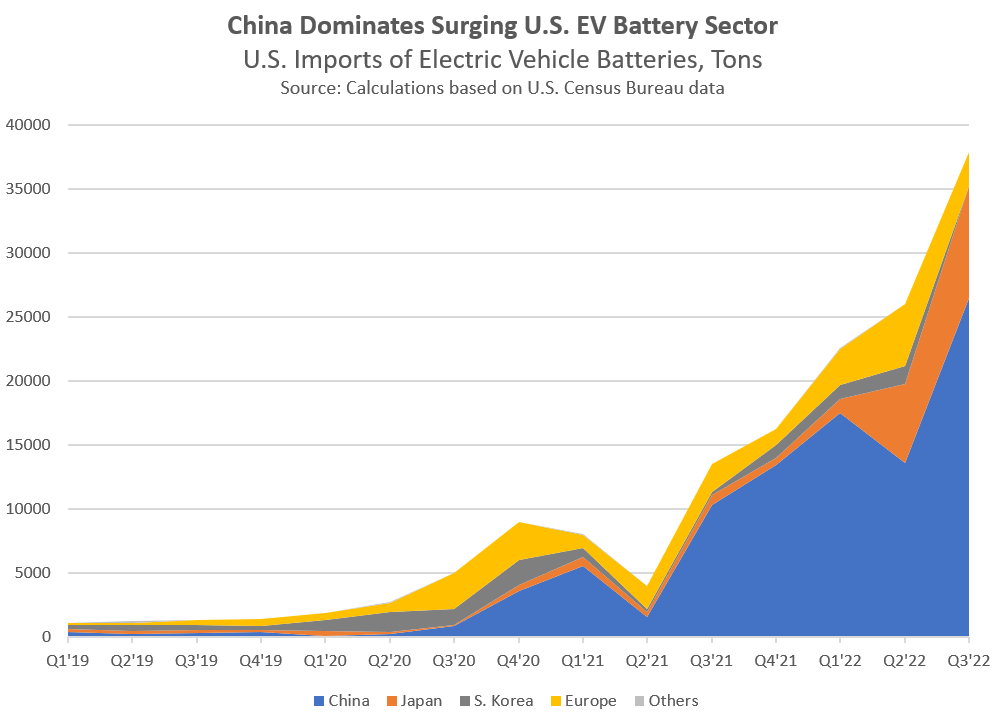

The U.S. and EU Trade and Technology Council meeting on Dec. 5 will seek to resolve differences between the two over the U.S. Inflation Reduction Act. The IRA provides support for electric vehicles (EVs) and renewables with preferential access for supplies from countries which the U.S. has a free trade deal with. The failure of TTIP leaves the EU outside that group.

President Biden has indicated that there are “tweaks that we can make that can fundamentally make it easier for European countries to participate” in IRA benefits. It’s not clear what these are, or whether Congressional approval is needed.

The chart above shows U.S. imports of EV batteries by source. The 180% year-over-year surge in total imports reflects new model production. China has come to dominate with a 70% share in Q3’22 compared to 26% in Q3’19. European suppliers’ volumes climbed 29% year over year, but have seen their market share fall to 7%.

The stakes are high for the EU. Volkswagen and Stellantis have both cast doubt on the viability of EU-based EV components and vehicle manufacturing. VW has specifically cited the high cost of energy as a concern. The lack of access to the U.S. as an export market would be another challenge for EU manufacturers.

BMW appears to have more faith in the EU, having doubled its planned investment in a Hungarian EV factory to incorporate battery manufacturing as well as vehicle assembly.

Suppliers from FTA countries are nonetheless still going in-market to access U.S. subsidies. The latest example is the plan by Hyundai to use SK ON’s batteries in its U.S. factory. The KORUS deal, renegotiated under the Trump administration, may provide eligibility for IRA money.

The TTC meeting will also include discussions of both EU and U.S. semiconductor subsidies, as well as U.S. pressure for the EU to limit exports of chip manufacturing equipment to China.

A resurgence of COVID-19 cases in China is causing a new round of lockdowns. While the focus has been on electronics, there has also been an impact on automotive manufacturing. Volkswagen, Honda, Toyota, and Yamaha have all had to restrict production.

The challenges in China will propagate across international automotive supply chains. China’s imports of automotive parts fell by 16% year over year in October, hitting their lowest in dollar terms since May 2020.

Chinese manufacturers’ sentiment fell to the lowest since April, in the November CFLP survey. New orders dropped to their lowest since the February 2020 pandemic low. That led production activity expectations to turn negative for the first time in at least three years.

U.S. manufacturing sentiment, measured by the ISM, fell into negative territory for the first time since May 2020. A marked slide in order backlog, including the fourth month of declining export orders, was a major driver of the worsening sentiment. That’s knocked onto the lowest import order reading since May 2020.

South Korea’s exports fell by 14% year over year in November and were their lowest since May 2021 in dollar terms. As shown in the chart above, a turnaround in exports of semiconductors, which fell by 30% year over year in November, is the main driver.

Reduced shipments of commodity-price-sensitive steel and petrochemicals have also been a drag. That ties up with the weakening manufacturing sentiment in China and the U.S.

India has reportedly received a request from Russia for supplies of over 500 industrial components and other goods. It’s reported that sanctions have cut into Russian imports of the products. As flagged above, India has become a significant buyer of Russian oil since the start of the war in Ukraine.

Kubota plans to build tractors in India to expand its market share in Africa. The costs involved in manufacturing in India are reportedly 30% less than in Kubota’s home market of Japan. The firm currently exports powertrain and other components from its Indian operations to Japan and the U.S.

Aerospace supply chains face continued challenges. Airbus CEO Guillaume Faury stated he does “not expect things to start getting better before the middle of next year. And we don’t expect the situation to be normalized before the end of next year.” Semiconductor supplies, energy costs, and elevated raw material prices are all factors the firm still faces.

A U.S. rail strike has been averted by Congressional action, imposing a settlement on the parties involved. That’s not a surprise given the prior precedent in 1992. There had already been some activity reductions in hazardous goods in anticipation of the strike.

Data for U.S. rail activity shows freight volumes handled so far in Q4’22 are 1% lower than a year earlier and 3% below the same period of 2019. Container handling by rail is down by 1% in both periods.

Ocean container shipping rates ex-China fell by 6.3% last week, marking the 21st straight weekly decline. They’re now down by 55%% since their most recent, mid-July peak. Rates are nonetheless still 1.8x their 2019 average.

Container line CMA CGM “expects to see a faster return to more normal freight rates in the fourth quarter and lower margins,” as it forecasts “energy costs to remain high, weighing … on consumer spending.”

The EU has formalized rules requiring maritime shipping firms to pay for their greenhouse gas emissions. These will be phased in for emissions made 2024 and will cover 100% of intra-European shipping emissions and 50% of those on routes starting or ending in the EU.

Consumer Goods - Stable Flows, Cheaper Warehouses

Returning to the topic of retail sales, there’s anecdotal evidence of slower growth during Q4’22 versus a year earlier compared to the growth rates in Q3’22 from a diverse range of retail firms:

Costco’s November sales indicate sales, excluding gasoline, increased by 5% year over year in the four weeks to Nov. 27, slower than the 7% rate seen for the quarter overall. Notably, e-commerce sales dropped by 9% year over year in the four-week period.

Dollar General, a beneficiary of consumers’ search for cheaper products, anticipates sales growth in the three months to Feb. 3 to rise by 6% to 7% versus a year earlier, down from the 11% rate experienced in the three months to Oct. 28, 2022.

Diversified clothing brand owner PVH forecasts Q4 revenues to rise by 4% on a constant currency basis, down from 7% in Q3, including an ongoing 2% drag from store closures in Russia.

Victoria’s Secret expects Q4 revenues, its peak for the year due to gift-giving, to “decrease in the high-single-digit (percentage) range” after a 9% decline in Q3’22.

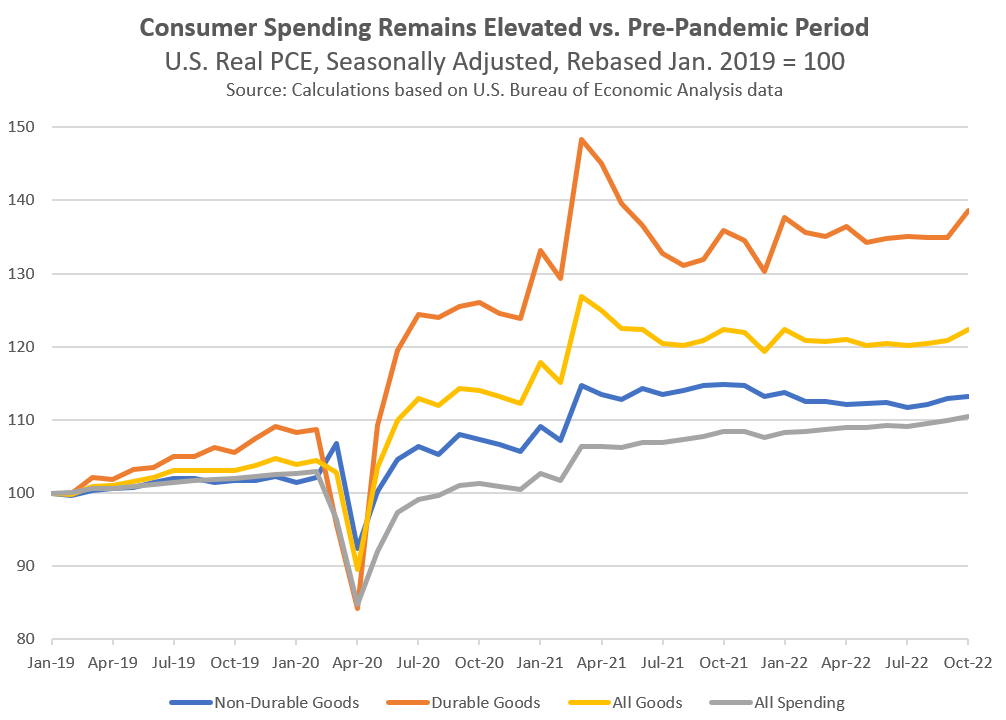

On a more contrasting note, Personal Consumption Expenditures on goods in the U.S. improved by 1% versus a month earlier in October on a seasonally adjusted basis. Spending on durable goods (e.g. furniture and appliances) increased by 2.7% while nondurables rose by a more modest 0.3%.

Yet, as indicated in the chart above, that meant goods spending nonetheless remained unchanged versus a year earlier. With goods spending still 22% above 2019 levels there’s a risk of a further reversal if economic conditions worsen.

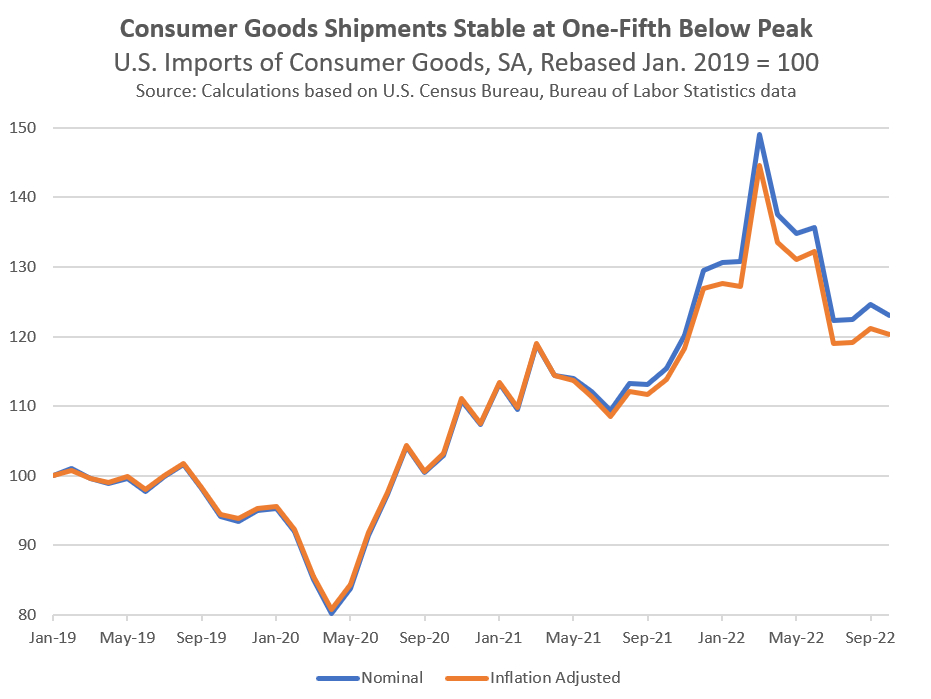

U.S. imports of consumer goods dipped by 1.2% sequentially on a nominal, seasonally adjusted basis in October. That partly reflects some deflation, import prices for consumer goods fell by 0.4% in October. As shown above, imports in both nominal and inflation-adjusted terms are around one-fifth below their Q2’22 peak.

Total U.S. imports increased by 1% in October versus September, largely reflecting increased food and oil-products prices. Exports meanwhile dropped by 2.6% to their lowest since February.

Warehouse storage rates across the U.S. fell by 2.2% in October according to WarehouseQuote data. That left them 15% below the June 2022 peak and at their lowest since March 2021. Pallet-in and pallet-out rates remain elevated, suggesting the cost of operating warehouses remains high.

Further downstream, the EU announced new packaging rules designed to cut waste by 15% in 2030 versus 2018 via reuse and recycling. Additional rules will ban certain types of packaging and mandate the use of recycled materials.

Supply chains for home and personal care goods as well as food may face the most significant challenges, though all products and components delivered in wrapping could face some degree of regulatory burden.

Disclaimer: This report is for information purposes only, not for legal, business, or financial decisions. It’s based on the latest available information on the publication date - that information may have changed by the time you read this report. Use it at your own risk.